Over the last decade, the automotive industry has experienced a technological revolution. Smart cars, also known as connected or autonomous vehicles, are now more common than ever. Equipped with advanced safety features, sensors, and communication technologies, these vehicles promise safer, more efficient roads. However, their growing presence is also reshaping the insurance industry in significant ways. One of the most direct effects is on auto insurance premiums. Drivers may wonder whether these cutting-edge features are saving them money or making their insurance more expensive. The answer is not simple, as smart cars have both cost-reducing and cost-increasing effects on auto premiums.

The Safety Factor: A Driver’s Best Friend

Smart cars are equipped with a wide range of safety technologies, including automatic emergency braking, lane-keeping assist, adaptive cruise control, blind spot monitoring, and collision avoidance systems. These features are designed to reduce the number and severity of accidents. From an insurance perspective, fewer accidents mean fewer claims, which can translate into lower premiums.

Insurance companies are increasingly taking these safety features into account when calculating premiums. For example, a vehicle with forward collision warning systems may be considered less risky than one without. As a result, the driver may enjoy a discount. Some insurers offer special programs or incentives for owners of vehicles with certain driver-assistance systems. This positive impact on premiums is one of the strongest selling points for smart cars.

The High Cost of Repairs

While safety features can reduce the frequency of accidents, the flipside is that smart cars are far more expensive to repair. A minor fender bender that once cost a few hundred dollars may now run into the thousands if it damages sensors, cameras, or other embedded technologies. These parts are not only costly but also require specialized labor to fix, which drives up the overall cost of claims.

Insurance companies must account for these higher repair costs when setting premiums. In some cases, this may offset the savings from reduced accident frequency. For example, replacing a bumper that includes ultrasonic sensors or radar modules is far more expensive than a standard bumper. As more smart cars hit the roads, insurers may need to increase premiums to cover the rising costs of even minor accidents.

Data Collection and Personalized Premiums

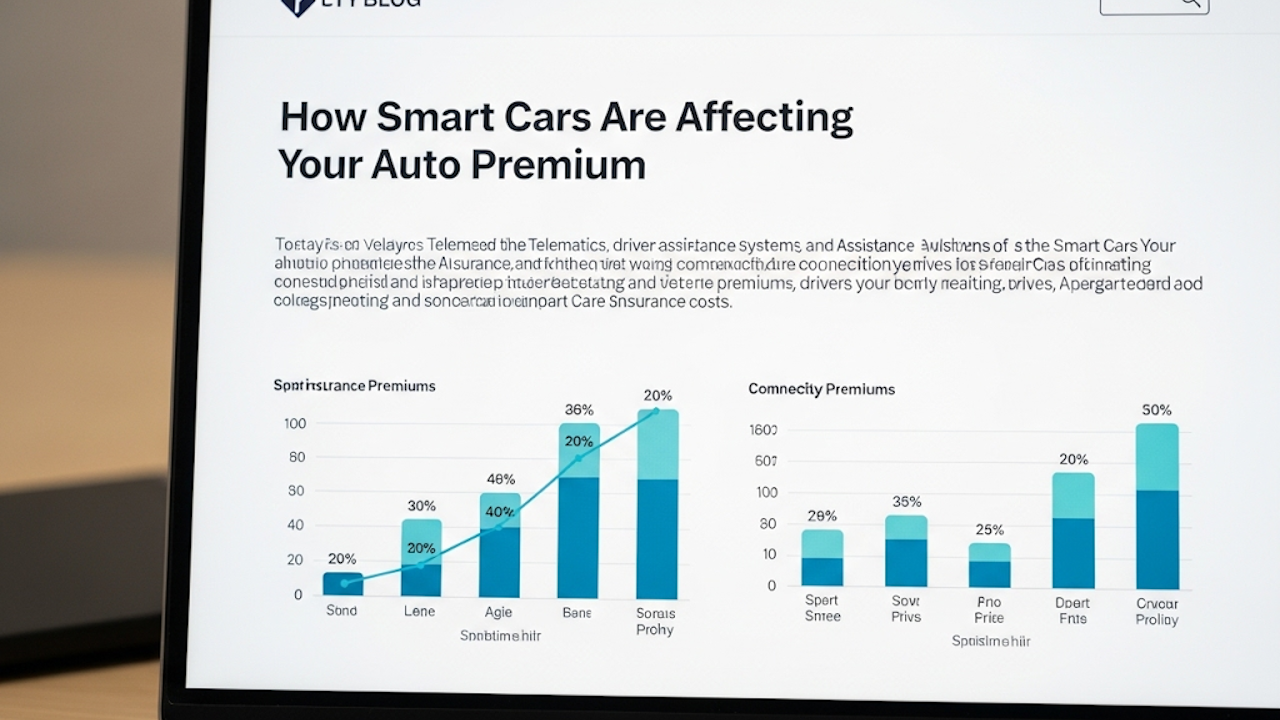

One of the most transformative aspects of smart cars is their ability to collect real-time data about driving behavior. Many smart cars track speed, braking patterns, time of day, and even location. This data can be shared with insurance companies, either directly through telematics programs or indirectly through connected apps.

This trend is enabling insurers to move toward usage-based insurance (UBI), where premiums are calculated based on actual driving habits rather than general risk categories like age or gender. Good drivers, especially those who drive fewer miles or avoid high-risk behaviors, can benefit from lower premiums. This personalized approach is seen as more fair and accurate.

However, not everyone is comfortable with the level of surveillance that usage-based insurance requires. Some consumers see it as an invasion of privacy. Others may be penalized for circumstances beyond their control, such as living in a high-traffic area. Still, for many drivers, the opportunity to save money by proving they are safe behind the wheel is appealing.

Cybersecurity and Liability Risks

Smart cars introduce new risks that traditional vehicles do not. Chief among these is cybersecurity. Since connected vehicles rely on software and communication networks, they can be vulnerable to hacking. A cyberattack could potentially disable safety features, steal personal data, or even take control of the vehicle.

From an insurance standpoint, this raises new questions about liability. If a vehicle is hacked and causes an accident, who is at fault? The driver, the manufacturer, or the software developer? These are complex issues that insurers are still trying to address. In the meantime, the uncertainty around cybersecurity could lead to higher premiums for smart cars, at least until clearer standards and protections are established.

The Shift in Liability with Autonomous Vehicles

Fully autonomous vehicles are still a few years away from becoming mainstream, but their emergence could fundamentally change auto insurance. As the role of the human driver diminishes, liability may shift toward the manufacturers and technology providers. This would likely reduce the need for personal auto insurance and increase the demand for product liability insurance.

For now, vehicles with partial autonomy still require active human oversight. Insurance companies are watching closely to see how these vehicles perform in the real world. Some early data suggests that partial automation can reduce accidents, while other reports indicate that drivers may become too reliant on the systems and react slower in emergencies. As insurers gather more data, premiums will likely be adjusted to reflect the actual risk.

Conclusion: A Mixed Bag for Consumers

The rise of smart cars is changing the auto insurance landscape in both positive and negative ways. On one hand, advanced safety features can lead to fewer accidents and lower premiums. On the other, the high cost of repairs and new risks like cybersecurity can drive premiums up. Add in the growing use of data for personalized insurance, and it becomes clear that premiums will vary more from person to person based on how they drive and what technologies their car includes.

For consumers, this means it is more important than ever to understand how their vehicle’s features affect their insurance. It may be worth shopping around for insurers who reward safe driving and offer discounts for smart car technologies. As the market continues to evolve, staying informed can help drivers make the most of the changes ahead.