In the fast-paced world of cryptocurrency and decentralized finance (DeFi), new investors often encounter exciting opportunities that promise high returns. However, this space also harbors significant risks, one of the most notorious being the “rug pull.” This term refers to a type of scam where project creators or insiders abruptly withdraw funds from a project, leaving investors holding worthless assets. For newcomers, understanding rug pulls is crucial to protecting your investments and navigating the crypto landscape safely. This article will delve into what rug pulls are, how they operate, real-world examples, warning signs, and strategies to avoid falling victim to them.

What Is a Rug Pull?

At its core, a rug pull is a fraudulent scheme in the cryptocurrency ecosystem where the developers or promoters of a token or project suddenly remove liquidity or sell off their holdings, causing the asset’s value to plummet to zero or near-zero. The name “rug pull” comes from the metaphor of pulling a rug out from under someone’s feet, leaving them to fall flat.

Rug pulls typically occur in decentralized exchanges (DEXs) like Uniswap on Ethereum or PancakeSwap on Binance Smart Chain, where anyone can create and list a token with minimal oversight. Unlike traditional stocks or regulated investments, crypto projects often lack formal audits, legal protections, or centralized authorities to enforce accountability. This anonymity and ease of entry make rug pulls alarmingly common, especially in the meme coin and DeFi sectors.

To put it simply, imagine investing in a new token hyped on social media as the next big thing. The price surges as more people buy in, but then the creators drain the pooled funds and disappear. Your investment evaporates overnight. While not all crypto projects are scams, rug pulls exploit the hype-driven nature of the market, preying on fear of missing out (FOMO) among inexperienced investors.

How Do Rug Pulls Work?

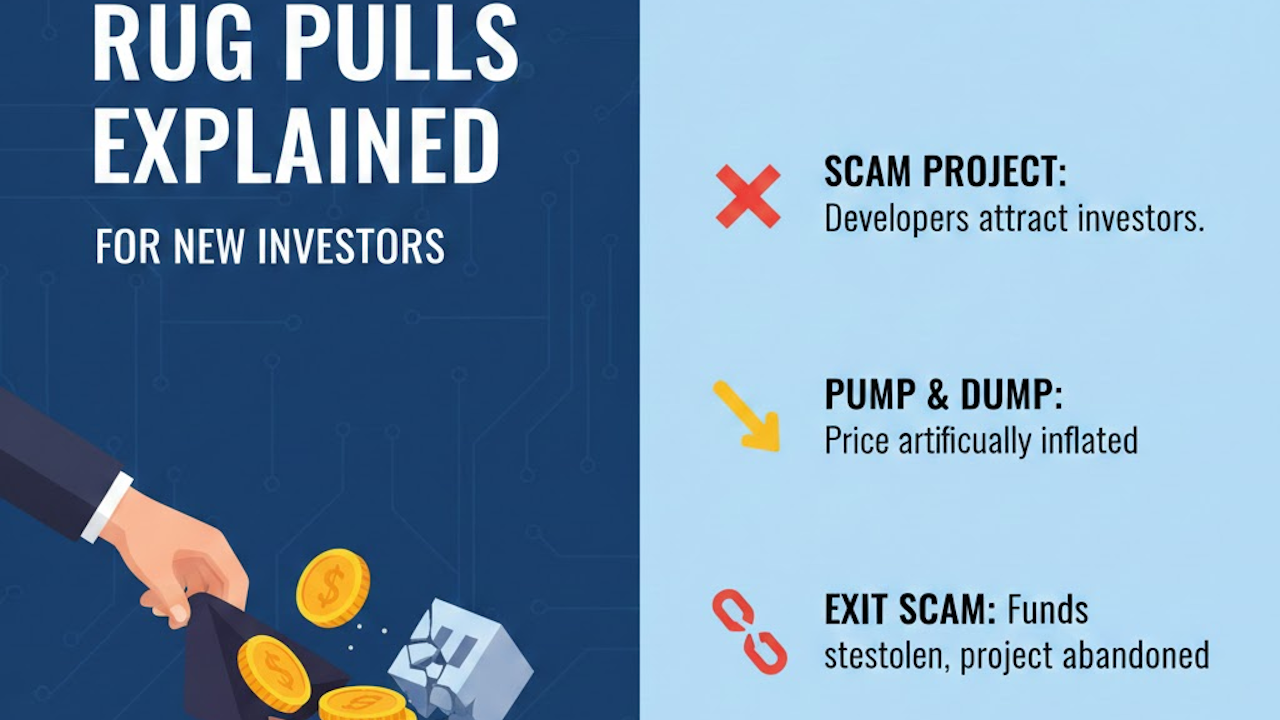

Rug pulls follow a predictable pattern, though scammers continually evolve their tactics to evade detection. Here’s a step-by-step breakdown of how a typical rug pull unfolds:

- Project Launch and Hype Building: Scammers create a new token using platforms like Ethereum’s ERC-20 standard or similar protocols on other blockchains. They often pair it with a legitimate cryptocurrency (like ETH or BNB) in a liquidity pool on a DEX. To attract investors, they build hype through social media channels such as Twitter (now X), Telegram, Discord, or Reddit. Fake endorsements from influencers, paid promotions, and viral marketing create buzz, promising revolutionary features like yield farming, NFTs, or charitable causes.

- Liquidity Provision and Token Distribution: The creators add initial liquidity to the pool, which allows trading to begin. They might distribute tokens through airdrops, presales, or fair launches to build a community. In some cases, they hold a large portion of the token supply themselves, often locked in smart contracts to appear trustworthy. However, these locks can be manipulated or bypassed.

- Price Pump: As investors buy in, the token’s price rises due to increased demand. This creates a positive feedback loop where early gains attract more buyers. Scammers may use bots to simulate trading volume or spread false narratives about partnerships and upcoming listings on major exchanges.

- The Pull: At the peak of hype, the scammers execute the rug pull. Common methods include:

- Liquidity Drain: They remove the liquidity from the pool, converting it back to a stable asset like ETH and withdrawing it to anonymous wallets.

- Mass Sell-Off: Insiders dump their large holdings, flooding the market and crashing the price.

- Smart Contract Exploits: Hidden backdoors in the code allow creators to mint unlimited tokens or transfer funds without restrictions.

- Abandonment: The team deletes social media accounts, shuts down websites, and vanishes, leaving the project unsupported.

- Aftermath: The token becomes illiquid and worthless. Investors are unable to sell their holdings at any meaningful price, resulting in total losses. Scammers launder the funds through mixers like Tornado Cash or move them to unregulated exchanges.

It’s worth noting that not every price crash is a rug pull. Legitimate projects can fail due to market conditions, poor execution, or competition. The key distinction is intent: rug pulls are deliberate frauds designed from the start to enrich the creators at the expense of others.

Types of Rug Pulls

Rug pulls aren’t one-size-fits-all; they vary in sophistication and execution. Understanding the different types can help new investors spot them early:

- Hard Rug Pulls: These are blatant and immediate. The team drains liquidity shortly after launch, often within hours or days. They’re common in low-effort meme coins with no real utility.

- Soft Rug Pulls: More subtle, these unfold over time. Creators gradually sell off tokens while maintaining the illusion of progress through fake updates. By the time investors realize, the damage is done.

- Limit Order Rug Pulls: Scammers set up automated sell orders at specific price points, triggering a cascade of sales that tanks the price.

- Honeypot Scams: A variant where the smart contract allows buying but prevents selling, trapping funds. This isn’t always a traditional rug pull but achieves similar results.

- Exit Scams in NFTs or DeFi Protocols: Beyond tokens, rug pulls can hit NFT projects (e.g., creators mint and sell rare items then abandon the roadmap) or lending platforms (e.g., draining protocol treasuries).

Data from blockchain analytics firms like Chainalysis shows that rug pulls accounted for billions in losses in recent years, with peaks during bull markets when hype is at its highest.

Famous Examples of Rug Pulls

To illustrate the real-world impact, let’s examine some infamous cases that have shaped investor caution in crypto:

- Squid Game Token (2021): Inspired by the Netflix series, this token surged over 300,000% in value before the creators pulled the rug, draining $3.3 million in liquidity. The website vanished, and holders couldn’t sell due to a honeypot mechanism. It highlighted how pop culture tie-ins can mask scams.

- AnubisDAO (2021): Marketed as a fork of OlympusDAO, it raised $60 million in a liquidity boot-strapping event. Within 24 hours, the funds were siphoned to anonymous wallets. This case underscored the risks of unaudited forks in DeFi.

- Luna Yield (2022): Amid the broader Terra-Luna collapse, this smaller project rug-pulled $2.3 million. It exploited the chaos of the larger ecosystem crash to slip under the radar.

- SafeMoon (Ongoing Scrutiny): While not officially labeled a rug pull, allegations of insider selling and unfulfilled promises have led to lawsuits. It serves as a cautionary tale of soft rugs where projects drag on but erode value over time.

These examples demonstrate that even high-profile projects aren’t immune. Always remember: if it sounds too good to be true, it probably is.

Warning Signs of a Potential Rug Pull

New investors can arm themselves by recognizing red flags. While no single sign guarantees a scam, a combination should prompt caution:

- Anonymous Team: If developers use pseudonyms without verifiable backgrounds or doxxing (revealing identities), it’s risky. Legitimate projects often have public LinkedIn profiles or GitHub activity.

- Lack of Audits: Reputable projects undergo smart contract audits from firms like Certik or PeckShield. Absence or fake audits are warnings.

- Locked Liquidity Claims: Check if liquidity is truly locked using tools like Unicrypt or Team Finance. Scammers fake this.

- Unrealistic Promises: Hype about 100x gains, celebrity endorsements without proof, or vague roadmaps signal trouble.

- Social Media Metrics: Fake followers, paid shills, or sudden account deletions are suspect. Use tools like Twitter audits to verify engagement.

- Token Distribution: If creators hold over 50% of supply, it’s a risk. Check on-chain data via Etherscan or BscScan.

- Rushed Launches: Projects launching without whitepapers, betas, or community input often aim for quick flips.

- High Transaction Fees or Restrictions: Unusual taxes on buys/sells that benefit wallets controlled by the team.

By conducting due diligence, you can filter out many potential rugs.

How to Avoid Rug Pulls

Prevention is your best defense. Here are practical steps for new investors:

- Research Thoroughly: Use resources like CoinMarketCap, DexScreener, or RugDoc to check project legitimacy. Read whitepapers critically and verify claims.

- Diversify Investments: Don’t put all eggs in one basket. Allocate small amounts to high-risk projects.

- Use Reputable Platforms: Stick to established DEXs and avoid unverified tokens. Consider centralized exchanges (CEXs) like Binance for added scrutiny.

- Monitor On-Chain Activity: Tools like Dune Analytics or Whale Alert track large wallet movements. Sudden dumps by team wallets are red flags.

- Join Communities Wisely: Engage in forums like CryptoMoonShots on Reddit, but cross-verify information.

- Set Stop-Losses: On DEXs, use limit orders to exit positions if prices drop sharply.

- Stay Informed: Follow crypto news from sources like CoinDesk or Decrypt. Regulatory bodies like the SEC occasionally warn about scams.

- Consider Hardware Wallets: Store assets offline to prevent hacks, though this doesn’t directly stop rugs.

Remember, even seasoned investors get rugged. Start small and learn from experiences.

Conclusion

Rug pulls represent a dark side of the crypto revolution, exploiting trust and innovation for personal gain. For new investors, the key takeaway is vigilance: educate yourself, question everything, and prioritize safety over quick profits. As the industry matures with better regulations and tools, rug pulls may decline, but they won’t disappear entirely. By understanding their mechanics and staying cautious, you can enjoy the benefits of crypto investing while minimizing risks. Always invest only what you can afford to lose, and view every opportunity through a skeptical lens. Happy investing!