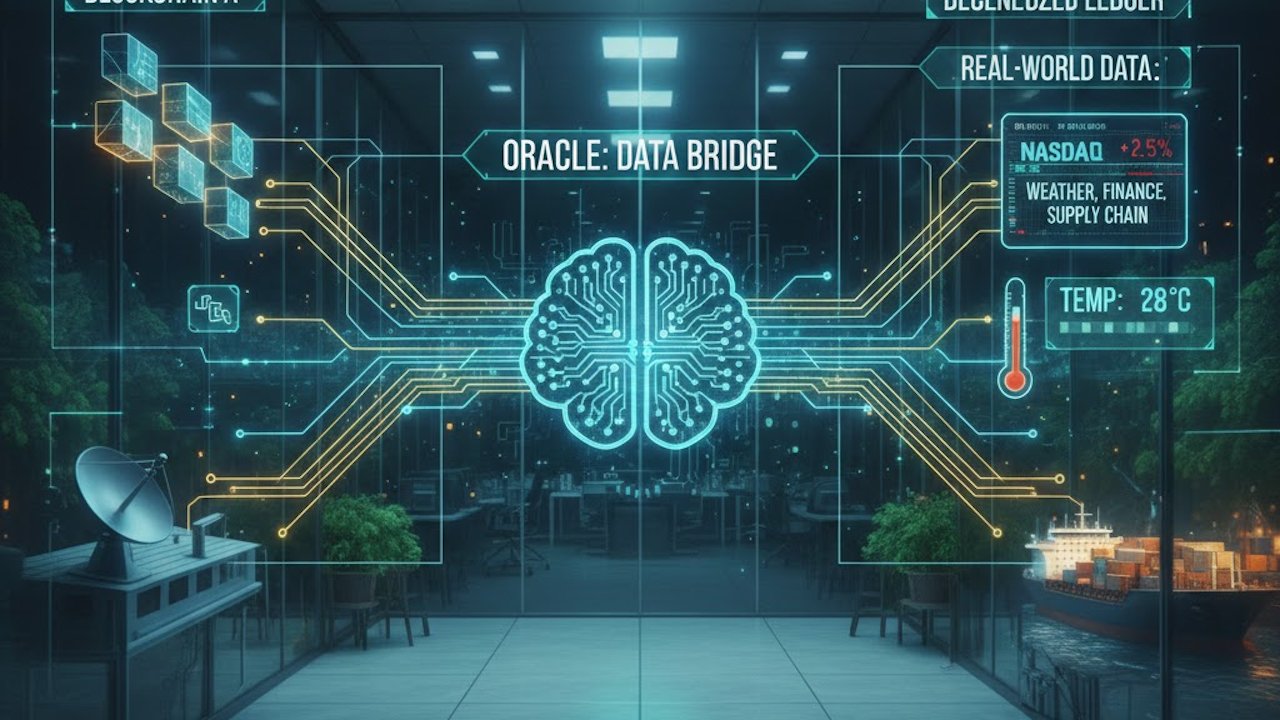

Blockchains have revolutionized the way we think about trust, data integrity, and decentralized systems. At their core, blockchains are distributed ledgers that record transactions in a secure, immutable manner across a network of computers. However, one fundamental limitation of blockchains is their isolation from the external world. Smart contracts, which are self-executing programs on blockchains, operate in a deterministic environment and cannot directly access real-world data or events, such as stock prices, weather conditions, or election results. This isolation ensures security and prevents tampering, but it also restricts the potential applications of blockchain technology. To overcome this barrier, oracles serve as the crucial bridge, enabling blockchains to interact with off-chain data and systems. Oracles are essentially third-party services or protocols that fetch, verify, and deliver external information to smart contracts, allowing them to respond to real-world inputs and outputs. Without oracles, many of the innovative use cases in decentralized finance (DeFi), supply chain management, and beyond would remain theoretical. In this article, we will explore the mechanics of oracles, their types, real-world applications, challenges, and future prospects, providing a comprehensive understanding of how they integrate blockchains with the broader ecosystem.

What Are Blockchain Oracles?

A blockchain oracle is a specialized entity designed to connect on-chain environments with off-chain data sources. In simple terms, oracles act as intermediaries that supply smart contracts with information from the real world, which blockchains cannot natively access due to their consensus-driven, closed-loop architecture. This data can include anything from financial market prices and sports scores to sensor readings and API responses from web services. Oracles are not part of the blockchain itself but operate as external agents that interact with it through predefined protocols. The concept of oracles addresses what is known as the “oracle problem,” which refers to the challenge of reliably introducing external data into a trustless system without compromising its security or decentralization. Early blockchain implementations, like Bitcoin, did not require oracles because they focused primarily on peer-to-peer transactions. However, with the rise of Ethereum and smart contracts, the need for external data became apparent, leading to the development of oracle solutions. Today, oracles are integral to Web3 ecosystems, enabling blockchains to function as dynamic, responsive platforms rather than static ledgers.

How Do Oracles Work?

The operation of a blockchain oracle can be broken down into several key steps: data retrieval, verification, transmission, and execution. First, when a smart contract requires external data, it sends a request to the oracle. The oracle then fetches the necessary information from off-chain sources, such as APIs, websites, or IoT devices. This retrieval process must be efficient and timely, especially for applications like financial trading where delays can lead to significant losses. Once the data is obtained, the oracle verifies its accuracy and authenticity. Verification methods vary but often involve multiple data sources, cryptographic signatures, or consensus mechanisms among oracle nodes to ensure the information is not manipulated or erroneous. After verification, the oracle transmits the data back to the smart contract on the blockchain. This transmission is typically done via a transaction that updates the contract’s state, triggering the execution of predefined logic based on the new input. For instance, if a smart contract for an insurance payout needs weather data to confirm a storm event, the oracle would pull that data from meteorological APIs, verify it against multiple providers, and feed it into the contract for automatic processing. Importantly, oracles can also handle outbound operations, where data from the blockchain is sent to external systems, such as triggering a payment in traditional banking rails upon contract fulfillment. This bidirectional flow makes oracles versatile tools for hybrid on-chain and off-chain applications.

Types of Blockchain Oracles

Blockchain oracles come in various forms, each tailored to specific needs in terms of data flow, decentralization, and functionality. One primary classification is based on data direction: inbound and outbound oracles. Inbound oracles deliver external data into the blockchain, such as price feeds for cryptocurrencies, which are essential for DeFi protocols. Outbound oracles, on the other hand, export data from the blockchain to the real world, enabling actions like notifying external systems of on-chain events. Another categorization focuses on the method of data delivery: push-based and pull-based oracles. Push-based oracles continuously or periodically send data to the blockchain without waiting for a request, which is useful for real-time applications like streaming market data. Pull-based oracles respond only when queried by a smart contract, offering on-demand efficiency for less frequent needs.

In terms of governance, oracles are divided into centralized and decentralized types. Centralized oracles rely on a single entity or provider to supply data, which can be faster and cheaper but introduces a single point of failure and potential trust issues. Decentralized oracles, such as those using networks of independent nodes, distribute the data fetching and verification process across multiple participants, enhancing security and resilience through consensus. Cross-chain oracles facilitate data transfer between different blockchains, supporting interoperability in multi-chain ecosystems. Compute-enabled oracles go beyond simple data provision by performing computations off-chain, such as aggregating data or running complex algorithms, before delivering results to the blockchain. Popular oracle networks exemplify these types; for example, Chainlink offers decentralized inbound and outbound services with compute capabilities, while Pyth focuses on high-speed financial data pushes. Understanding these types helps developers choose the right oracle for their application’s requirements, balancing factors like speed, cost, and security.

Popular Oracle Networks and Implementations

Several oracle networks have emerged as leaders in the space, each with unique features. Chainlink, one of the most widely adopted, operates a decentralized network of nodes that provide secure data feeds, verifiable randomness, and cross-chain communication. It uses staking mechanisms to incentivize honest behavior among node operators. Pyth Network specializes in financial data, delivering sub-second price updates for assets like stocks and cryptocurrencies through a pull-based model. API3 emphasizes direct data provider integration, allowing APIs to sign data on-chain for enhanced authenticity. Band Protocol offers a flexible, decentralized oracle framework that supports custom data queries across multiple blockchains. These networks often integrate with major blockchains like Ethereum, Solana, and Polygon, providing plug-and-play solutions for developers. As of 2026, advancements in these platforms include better integration with layer-2 scaling solutions and AI-driven data verification, further solidifying their role in the ecosystem.

Use Cases of Blockchain Oracles

The integration of oracles unlocks a myriad of practical applications across industries. In decentralized finance (DeFi), oracles are indispensable for providing accurate price feeds. Lending platforms like Aave use oracle data to determine collateral values and trigger liquidations, preventing undercollateralized loans. Automated market makers rely on oracles for fair pricing in token swaps. Beyond finance, oracles enable parametric insurance, where payouts are automatically disbursed based on real-world events, such as flight delays verified via airport APIs or crop failures confirmed by satellite weather data. In supply chain management, oracles track goods in real-time using IoT sensors, ensuring transparency and automating payments upon delivery milestones.

Gaming and NFTs benefit from oracles through verifiable randomness for loot boxes or provably fair lotteries, mitigating cheating risks. Oracles also support prediction markets, where users bet on outcomes like elections or sports, with oracles settling bets based on official results. In the realm of social impact, oracles can verify carbon credits or humanitarian aid distribution using external databases. Emerging use cases include AI-enhanced smart contracts, where oracles feed machine learning models with off-chain data for predictive analytics. These examples illustrate how oracles expand blockchain’s utility, transforming it from a niche technology into a foundational layer for global systems.

Challenges and Risks Associated with Oracles

Despite their benefits, oracles introduce several challenges and risks that must be addressed for widespread adoption. The oracle problem itself highlights the inherent tension: blockchains are trustless, but oracles require trust in external data sources. Data manipulation is a primary concern; if an oracle provides inaccurate information, it can lead to faulty smart contract executions, as seen in past DeFi exploits where price oracle tampering caused millions in losses. Centralized oracles exacerbate this by creating single points of failure, where a hack or downtime can disrupt entire ecosystems. Even decentralized oracles face issues like network congestion, which can delay data delivery, or collusion among nodes to provide false consensus.

Privacy is another challenge, especially when dealing with sensitive data that cannot be exposed on-chain. Additionally, the cost of oracle services, including gas fees for on-chain transmissions, can make frequent queries expensive. Regulatory risks arise as oracles handle real-world data, potentially subjecting them to compliance requirements in finance or data protection laws. To mitigate these, solutions like multi-source aggregation, cryptographic proofs, and insurance mechanisms for oracle failures are being developed. Ongoing research focuses on zero-knowledge oracles that verify data without revealing it, enhancing both security and privacy.

The Future of Blockchain Oracles

Looking ahead, the evolution of oracles is poised to drive the next wave of blockchain innovation. As Web3 matures, oracles will likely become more integrated with artificial intelligence, enabling smarter data processing and predictive capabilities. Advances in decentralized oracle networks aim to achieve greater scalability, reducing latency for high-frequency applications like real-time trading. Interoperability standards will allow seamless data sharing across blockchains, fostering a unified multi-chain environment. Enterprise adoption is expected to grow, with solutions like those from Google Cloud and DZ BANK addressing institutional needs for reliable data delivery. Moreover, the incorporation of quantum-resistant cryptography will future-proof oracles against emerging threats. By solving current limitations, oracles will not only connect blockchains to the real world but also pave the way for autonomous, intelligent systems that blend decentralized computing with everyday realities.

Conclusion

Blockchain oracles represent a pivotal advancement in bridging the gap between isolated ledgers and the dynamic real world. By providing secure, verifiable access to external data, they empower smart contracts to handle complex, real-time scenarios across diverse sectors. From their basic mechanics to advanced types and applications, oracles have transformed blockchain from a theoretical construct into a practical tool for innovation. However, addressing ongoing challenges like security and decentralization is crucial for their sustained growth. As technology progresses, oracles will continue to play a central role in realizing the full potential of decentralized systems, ultimately creating a more interconnected and efficient global infrastructure.