Bitcoin and Ethereum stand as the two dominant forces in the cryptocurrency landscape, collectively representing over 70% of the total market capitalization in late 2025. Bitcoin, launched in 2009 by the pseudonymous Satoshi Nakamoto, pioneered decentralized digital currency. Ethereum, introduced in 2015 by Vitalik Buterin and a team of developers, expanded the concept into a programmable blockchain platform. While both operate on blockchain technology and enable peer-to-peer transactions without intermediaries, their designs, purposes, and ecosystems diverge significantly. This article explores these differences in depth, drawing on their technical foundations, economic models, use cases, and performance as of December 2025.

Origins and Core Philosophy

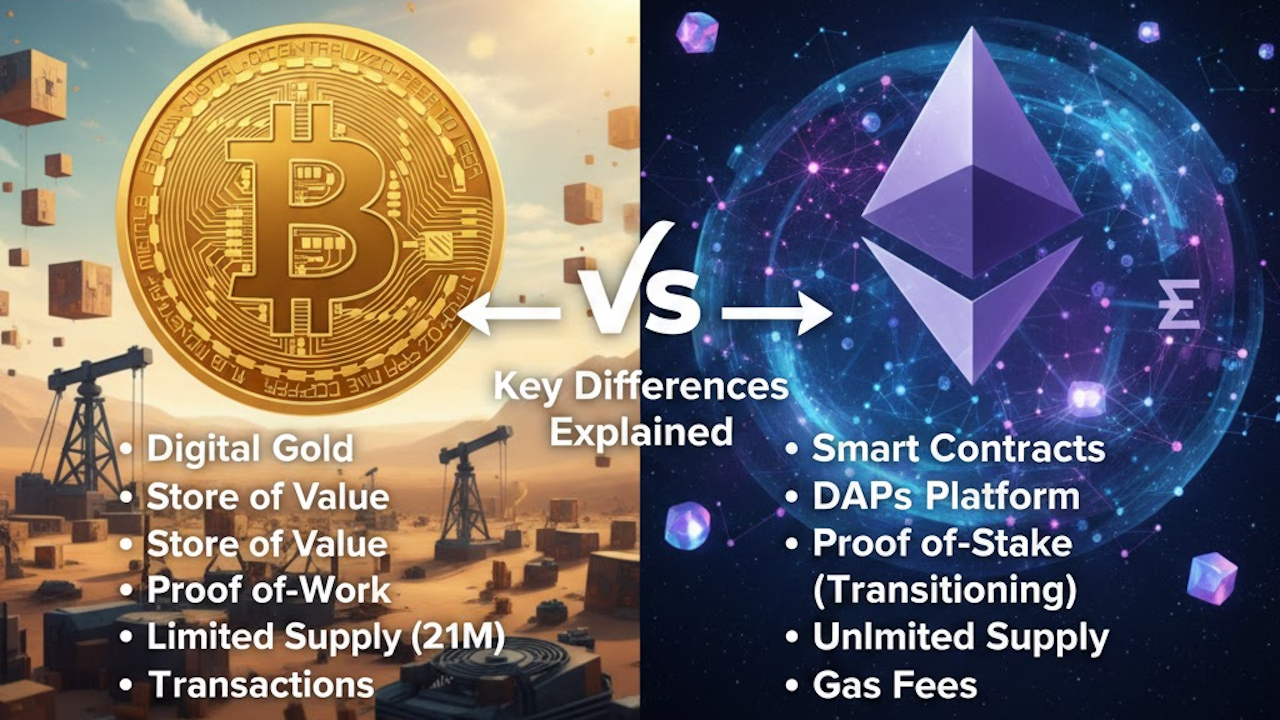

Bitcoin emerged as a response to the 2008 financial crisis, aiming to create a decentralized electronic cash system resistant to censorship and central control. Its whitepaper describes it as “a purely peer-to-peer version of electronic cash” that allows direct transactions without trusted third parties like banks. Bitcoin’s philosophy emphasizes scarcity, security, and simplicity, positioning it primarily as a store of value often likened to “digital gold.”

Ethereum, by contrast, was designed as a general-purpose computing platform. Its founders envisioned a “world computer” where developers could build decentralized applications (dApps) using smart contracts: self-executing code that automates agreements. Ethereum’s core innovation lies in its Turing-complete programming language, enabling complex logic beyond simple transfers. This shift from currency to platform marks a fundamental philosophical difference: Bitcoin prioritizes monetary sovereignty, while Ethereum focuses on enabling innovation in decentralized finance (DeFi), non-fungible tokens (NFTs), and beyond.

Consensus Mechanisms and Security

One of the most prominent distinctions is how each network achieves consensus and secures transactions.

Bitcoin relies on Proof-of-Work (PoW), where miners compete to solve computational puzzles to validate blocks and earn rewards. This mechanism has proven highly secure, with Bitcoin’s network never suffering a major attack in over 16 years. However, PoW is energy-intensive, consuming significant electricity comparable to some countries’ annual usage.

Ethereum transitioned to Proof-of-Stake (PoS) with “The Merge” in 2022, a landmark upgrade that reduced its energy consumption by over 99%. In PoS, validators stake ETH as collateral to propose and attest blocks, with penalties (slashing) for malicious behavior. This makes Ethereum far more environmentally sustainable and allows for faster finality. Subsequent upgrades like Dencun (2024) introduced proto-danksharding for better data availability, while Pectra (May 2025) enhanced staking flexibility and Layer-2 integration. A further upgrade, Fusaka, activated in late 2025, expanded data capacity via PeerDAS, supporting cheaper Layer-2 transactions.

As of December 2025, Bitcoin’s PoW remains unchanged, with upgrades like Taproot (2021) adding limited smart contract functionality but maintaining its minimalist approach. Ethereum’s ongoing roadmap, including plans for full danksharding, prioritizes scalability and efficiency.

Supply Models and Economics

Bitcoin features a hard-capped supply of 21 million coins, enforcing scarcity through programmed halvings every four years that reduce mining rewards. By late 2025, over 19.8 million BTC are in circulation, with the latest halving in 2024 further slowing issuance. This deflationary model underpins Bitcoin’s store-of-value narrative.

Ethereum has no fixed cap, with approximately 120 million ETH in circulation as of December 2025. However, EIP-1559 (introduced in 2021) burns a portion of transaction fees, often making ETH deflationary during high activity. Post-Merge issuance is lower under PoS, and upgrades like Pectra adjusted validator limits to balance security and decentralization. Ethereum’s economics tie more to network utility: higher usage burns more ETH, potentially increasing scarcity.

These models influence investor perceptions. Bitcoin’s fixed supply appeals to those seeking a hedge against inflation, while Ethereum’s utility-driven demand fluctuates with ecosystem growth.

Transaction Speed, Scalability, and Fees

Bitcoin processes blocks every 10 minutes, limiting throughput to about 7 transactions per second (TPS) on the base layer. This deliberate slowness enhances security but results in higher fees during congestion. Layer-2 solutions like the Lightning Network enable faster, cheaper payments off-chain.

Ethereum’s base layer targets 12-second blocks, achieving around 15-30 TPS natively. However, its real scalability comes from Layer-2 rollups (e.g., Optimism, Arbitrum), which batch transactions and settle on the main chain. The Dencun upgrade dramatically reduced Layer-2 fees via blobs, and Pectra doubled blob capacity. Fusaka in 2025 further boosted data availability, making Layer-2s process thousands of TPS at fractions of a cent. In late 2025, average Ethereum gas fees hover low, with Layer-2 transactions often under $0.01.

Bitcoin excels in final settlement security, while Ethereum leads in high-throughput applications.

Use Cases and Ecosystems

Bitcoin’s primary use is as a digital asset for value storage and transfer. Institutional adoption, including spot ETFs and corporate treasuries (e.g., MicroStrategy), reinforces this. Limited scripting supports basic applications, but Bitcoin avoids complexity to preserve decentralization.

Ethereum powers a vast ecosystem. Smart contracts enable DeFi protocols (lending, borrowing without banks), NFTs, decentralized exchanges, and gaming. In 2025, Ethereum retains the highest total value locked (TVL) in DeFi, despite competition from faster chains. Real-world assets (RWAs) tokenization and institutional products increasingly build on Ethereum. Its developer community remains the largest, with standards like ERC-20 and ERC-721 dominating tokenized assets.

Bitcoin focuses on monetary purity; Ethereum on programmable money and applications.

Market Performance and Adoption in 2025

As of late December 2025, Bitcoin trades around $87,000-$88,000, with a market cap near $1.73 trillion, comprising over 57% of the crypto market (Bitcoin dominance). It reached highs above $109,000 earlier in the year but corrected amid year-end volatility.

Ethereum trades near $2,900-$3,000, with a market cap around $352 billion. It hit all-time highs near $4,950 in mid-2025 but faced pressure from outflows and competition. The ETH/BTC ratio hovers low, reflecting Bitcoin’s relative strength.

Institutional interest favors Bitcoin via ETFs, while Ethereum benefits from staking yields and ecosystem utility. Both saw adoption growth, but Bitcoin’s simplicity aids its “digital gold” status, whereas Ethereum’s innovation drives periodic surges tied to upgrades.

Environmental Impact and Sustainability

Bitcoin’s PoW draws criticism for energy use, though miners increasingly use renewables. Ethereum’s PoS shift made it highly efficient, aligning with sustainability goals.

Risks and Competition

Bitcoin risks regulatory scrutiny as a commodity-like asset but benefits from network effects. Ethereum faces competition from high-throughput Layer-1s (e.g., Solana) and must manage Layer-2 fragmentation.

Conclusion: Complementary Giants

Bitcoin and Ethereum are not direct rivals but complementary assets. Bitcoin offers unparalleled security and scarcity as a global reserve asset. Ethereum provides a flexible platform for innovation, powering the decentralized web. In 2025, Bitcoin maintains leadership in market dominance and institutional appeal, while Ethereum evolves rapidly through upgrades, leading in application diversity. Investors often hold both: Bitcoin for preservation, Ethereum for growth potential. As blockchain matures, their differences highlight the sector’s breadth, from sound money to programmable finance.