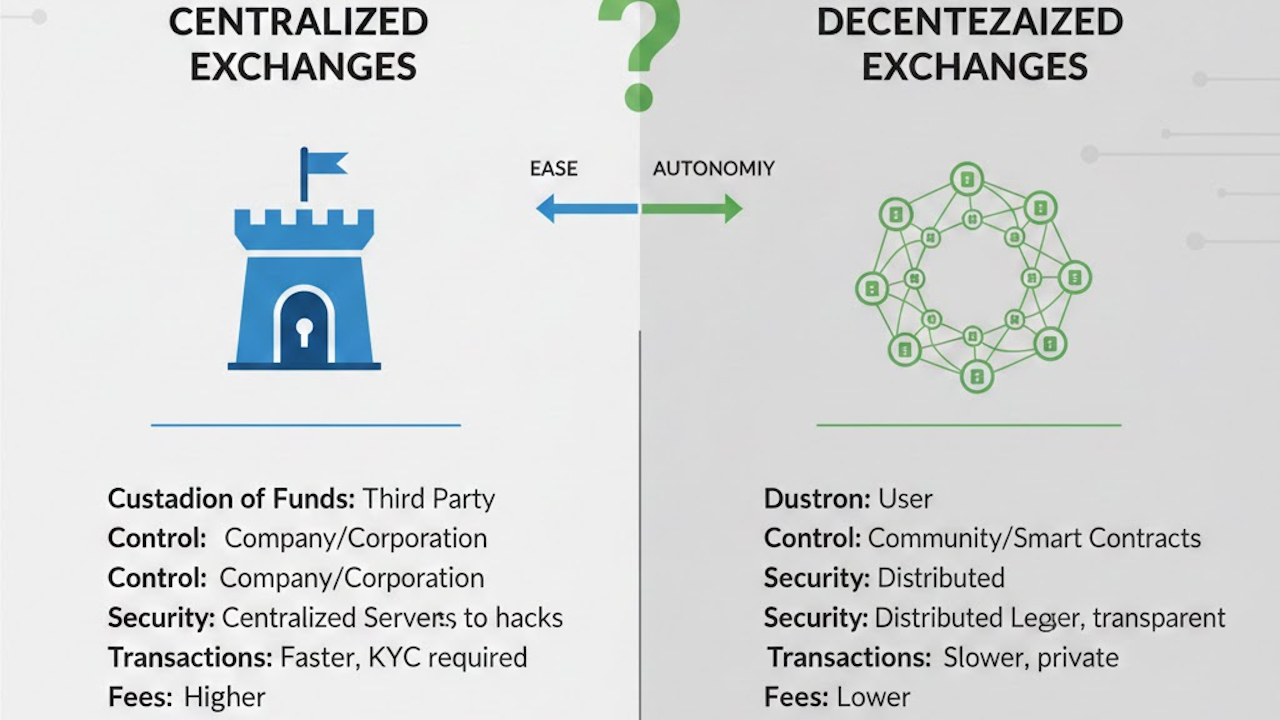

In the rapidly evolving world of cryptocurrency and digital assets, exchanges serve as the primary gateways for buying, selling, and trading. These platforms facilitate the exchange of cryptocurrencies like Bitcoin, Ethereum, and countless altcoins, as well as fiat currencies in some cases. Broadly, exchanges fall into two main categories: centralized exchanges (CEXs) and decentralized exchanges (DEXs). This article delves deeply into the differences between these two models, exploring their structures, advantages, disadvantages, operational mechanics, and implications for users, investors, and the broader financial ecosystem. By examining key aspects such as security, liquidity, user experience, fees, regulatory compliance, and future prospects, we aim to provide a thorough understanding to help readers make informed decisions in this dynamic space.

Understanding Centralized Exchanges (CEXs)

Centralized exchanges operate much like traditional stock exchanges or banks, where a central authority manages the platform. This entity, often a company, controls the order books, matches buyers and sellers, holds user funds, and oversees all transactions. Popular examples include Binance, Coinbase, Kraken, and Bybit, which have dominated the crypto trading landscape since the early days of Bitcoin.

How CEXs Work

On a CEX, users typically create an account, complete Know Your Customer (KYC) verification, and deposit funds either in fiat (like USD or GBP) or crypto. The exchange acts as a custodian, meaning it holds the private keys to users’ wallets. Trades are executed through a centralized order book, where buy and sell orders are matched in real time. This setup allows for advanced features like margin trading, futures contracts, and spot trading with high speed and efficiency.

CEXs rely on servers and databases controlled by the operator, which enables them to offer tools such as charting software, API integrations for algorithmic trading, and customer support. For instance, Binance processes millions of transactions per day with minimal downtime, thanks to its robust infrastructure.

Advantages of CEXs

One of the primary strengths of centralized exchanges is their high liquidity. Liquidity refers to the ease with which assets can be bought or sold without significantly affecting the price. CEXs aggregate orders from a vast user base, resulting in tight bid-ask spreads and large trading volumes. As of early 2026, Binance alone reports daily trading volumes exceeding $50 billion, making it a go-to for institutional investors.

User experience is another key benefit. CEXs often feature intuitive interfaces, mobile apps, and educational resources, lowering the barrier to entry for beginners. Features like fiat on-ramps (direct bank transfers) and off-ramps make it simple to convert crypto to cash. Additionally, CEXs provide insurance funds or compensation schemes in case of hacks, as seen with Coinbase’s coverage for user assets.

Speed and efficiency are hallmarks of CEXs. Transactions confirm almost instantly, unlike some blockchain-based systems that suffer from network congestion. This makes them ideal for day traders and high-frequency trading strategies.

Disadvantages of CEXs

Despite their strengths, CEXs have notable drawbacks. The most prominent is the risk of centralization itself: users must trust the exchange with their funds. History is rife with examples of failures, such as the 2014 Mt. Gox hack, where 850,000 Bitcoins were lost, or the 2022 FTX collapse, which exposed billions in mismanaged assets. Even in 2026, with improved security protocols, hacks remain a threat; centralized points of failure attract cybercriminals.

Regulatory scrutiny is another issue. CEXs must comply with laws in multiple jurisdictions, leading to mandatory KYC and Anti-Money Laundering (AML) checks. This can invade user privacy and exclude individuals from regions with strict regulations. For users in places like the UK or EU, this means providing personal identification, which some view as a loss of anonymity.

Fees on CEXs can add up. While spot trading fees are often low (around 0.1% per trade), withdrawal fees, especially for fiat, can be substantial. Moreover, during market volatility, exchanges may impose temporary halts or increase fees to manage load.

Understanding Decentralized Exchanges (DEXs)

In contrast, decentralized exchanges operate without a central authority, leveraging blockchain technology and smart contracts to facilitate peer-to-peer (P2P) trading. DEXs run on distributed networks like Ethereum, Solana, or Binance Smart Chain, where users retain control of their funds. Notable examples include Uniswap, PancakeSwap, SushiSwap, and dYdX, which have surged in popularity amid growing demand for financial sovereignty.

How DEXs Work

DEXs use automated market makers (AMMs) or order book models powered by smart contracts. In an AMM system, like Uniswap’s, liquidity providers deposit token pairs into pools, and prices are determined algorithmically via formulas such as constant product (x*y=k). Users connect their wallets (e.g., MetaMask) directly to the platform, approve transactions, and swap assets without intermediaries. No KYC is required, preserving pseudonymity.

Transactions occur on-chain, meaning they are recorded on the blockchain, ensuring transparency. For example, a trade on Uniswap involves interacting with a smart contract that executes the swap atomically, reducing counterparty risk.

Advantages of DEXs

The core appeal of DEXs is decentralization, which enhances security. Users never relinquish control of their private keys, embodying the “not your keys, not your crypto” mantra. This minimizes the risk of exchange-wide hacks; even if a DEX protocol is exploited, individual funds remain safe unless the user approves a malicious transaction. In 2025, DEXs like Uniswap V4 introduced advanced security features, such as hook-based customizations, further bolstering resilience.

Privacy is a significant plus. Without KYC, users can trade anonymously, appealing to those prioritizing financial freedom. This aligns with the ethos of blockchain, where transactions are pseudonymous yet verifiable.

DEXs often have lower barriers to entry for listing tokens. Anyone can create and list a new asset via liquidity pools, fostering innovation and access to emerging projects. Fees are typically transparent and go to liquidity providers rather than a central entity, with averages around 0.3% per swap on Uniswap.

Moreover, DEXs promote censorship resistance. They operate globally without borders, allowing users in restricted regions to participate. During geopolitical tensions, such as those in 2024-2025, DEX volumes spiked as users sought alternatives to regulated CEXs.

Disadvantages of DEXs

DEXs are not without challenges. Liquidity can be fragmented across pools and chains, leading to slippage (price impact) on large trades. While aggregate DEX volumes reached over $1 trillion in 2025, they still lag behind top CEXs for major pairs.

User experience often suffers due to complexity. Connecting wallets, managing gas fees (transaction costs on networks like Ethereum), and navigating interfaces can intimidate newcomers. High gas fees during congestion periods, sometimes exceeding $50 per transaction, deter casual users.

Scalability issues persist. Blockchain networks have limited throughput; Ethereum processes about 30 transactions per second, causing delays. Layer-2 solutions like Optimism or Arbitrum help, but they add layers of complexity.

Regulatory uncertainty looms. While DEXs evade direct oversight, governments are increasingly targeting them. In 2026, proposals in the US and EU aim to regulate DeFi protocols, potentially requiring compliance that undermines decentralization.

Direct Comparison: Key Metrics

To highlight the contrasts, let’s compare CEXs and DEXs across critical dimensions.

Security

CEXs: Vulnerable to hacks and insider threats due to custodial control. However, many employ multi-factor authentication, cold storage, and audits. Post-FTX, industry standards improved, with proof-of-reserves becoming common.

DEXs: Generally more secure for users, as funds stay in personal wallets. Risks include smart contract bugs (e.g., the 2022 Ronin Bridge exploit) and front-running by miners. Audits by firms like Certik mitigate this.

Winner: DEXs for individual security, but CEXs for institutional-grade protections.

Liquidity and Trading Volume

CEXs: Superior liquidity, with deep order books and high volumes. Ideal for large trades without slippage.

DEXs: Improving, especially on aggregated platforms like 1inch, but still fragmented. Cross-chain DEXs like THORChain address this.

Winner: CEXs, though DEXs are closing the gap.

User Experience and Accessibility

CEXs: User-friendly with fiat integrations, apps, and support. However, KYC can be a hurdle.

DEXs: Steeper learning curve, no customer service, but global access without restrictions.

Winner: CEXs for beginners; DEXs for advanced users.

Fees

CEXs: Variable, including trading, withdrawal, and inactivity fees. Often lower for high-volume traders via tiers.

DEXs: Primarily swap fees plus network gas. Can be cheaper overall but volatile with gas prices.

Winner: Tie, depending on usage.

Regulation and Compliance

CEXs: Heavily regulated, offering legal protections but at the cost of privacy.

DEXs: Largely unregulated, providing freedom but exposing users to scams and rug pulls (sudden liquidity removals).

Winner: CEXs for safety in regulated environments; DEXs for autonomy.

Innovation and Features

CEXs: Rich in derivatives, staking, and lending products.

DEXs: Excel in novel DeFi mechanics like yield farming and flash loans.

Winner: DEXs for cutting-edge innovation.

Future Trends and Considerations

As we move further into 2026, the lines between CEXs and DEXs are blurring. Hybrid models, such as centralized front-ends with decentralized back-ends (e.g., Binance’s DEX on BNB Chain), combine the best of both worlds. Regulatory developments, like the EU’s MiCA framework, will push CEXs toward transparency while challenging DEX anonymity.

Adoption of layer-2 scaling and zero-knowledge proofs promises to make DEXs more efficient, potentially surpassing CEXs in volume. Meanwhile, CEXs are integrating DeFi elements, like Coinbase’s Base chain.

For users, the choice depends on priorities: opt for CEXs if you value convenience and liquidity, or DEXs for control and privacy. Diversifying across both can mitigate risks. Ultimately, as blockchain matures, the debate may evolve from “vs” to “and,” with integrated ecosystems benefiting all participants.

In conclusion, centralized and decentralized exchanges represent two philosophies in finance: trust in institutions versus trust in code. Each has transformed how we interact with digital assets, and their ongoing competition drives innovation in the crypto space. Whether you’re a novice trader or a seasoned investor, understanding these differences is crucial for navigating this exciting frontier.