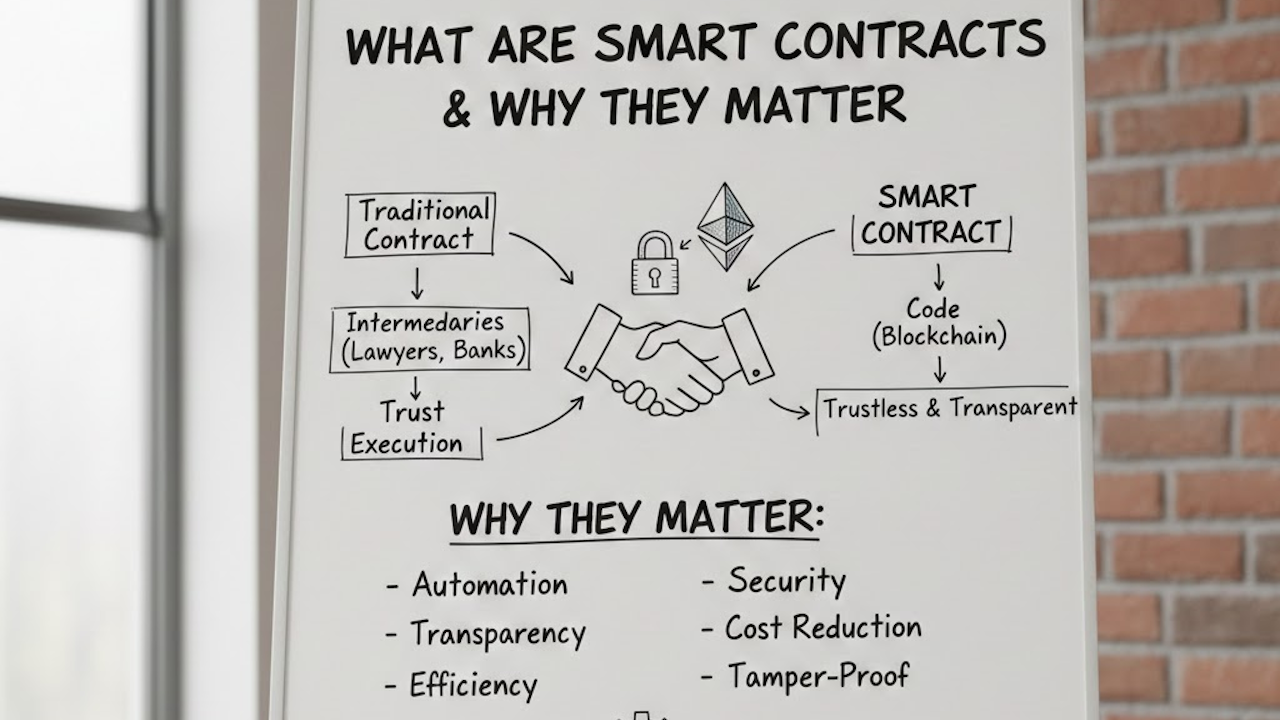

Smart contracts represent one of the most transformative innovations in blockchain technology. At their core, they are self-executing programs that automatically enforce the terms of an agreement when predefined conditions are met. Unlike traditional contracts, which rely on paper documents, legal language, and intermediaries to oversee compliance, smart contracts operate through code deployed on a blockchain network. This automation eliminates the need for trusted third parties, reduces human error, and ensures transparency in execution.

The concept traces its origins to the 1990s, when computer scientist and cryptographer Nick Szabo first described smart contracts as computerized transaction protocols that execute contract terms. Szabo envisioned extending digital transaction methods, such as point-of-sale systems, into broader applications, including synthetic assets combining derivatives and bonds. He famously compared smart contracts to vending machines: insert the correct input (money and selection), and the machine automatically dispenses the output (the chosen item) without further intervention. Although the idea predated blockchain, it found its practical realization with the launch of Ethereum in 2015. Ethereum introduced a Turing-complete programming environment, allowing developers to write complex smart contracts in languages like Solidity, turning Szabo’s theoretical framework into a functional reality.

Today, smart contracts are defined as computer programs or transaction protocols designed to automatically execute, control, or document events and actions according to the terms of an agreement. They follow simple “if/when…then…” logic: when specific conditions are verified on the blockchain, the contract triggers predefined actions, such as transferring funds, registering ownership, or issuing notifications. Once deployed, these contracts are immutable, meaning their code cannot be altered, and transactions are irreversible and traceable on the distributed ledger.

How Smart Contracts Work

The mechanics of smart contracts are straightforward yet powerful. Developers first define the agreement’s terms, including data representation on the blockchain, rules for transactions, potential exceptions, and dispute resolution frameworks. The code is then written, typically in Solidity for Ethereum-compatible chains, and compiled into bytecode for execution on a virtual machine, such as the Ethereum Virtual Machine (EVM).

Deployment involves sending the contract to the blockchain, where it receives a unique address. From there, it remains dormant until triggered by transactions or external inputs. For real-world integration, smart contracts often rely on oracles: trusted data feeds that supply off-chain information, like weather data for insurance claims or price feeds for financial derivatives. When conditions are met and verified by network nodes, the contract executes automatically. The blockchain updates with the transaction, ensuring permanence and visibility to authorized parties.

This process leverages blockchain’s key properties: decentralization (no single point of control), immutability (resistance to tampering), and transparency (auditable records). However, smart contracts are not inherently legal documents; they automate execution rather than create binding obligations under traditional law, though hybrid “smart legal contracts” are emerging that combine code with natural-language terms.

Why Smart Contracts Matter: Key Advantages

Smart contracts address longstanding inefficiencies in traditional contracting, making them highly relevant in a digital economy. Their importance stems from several core benefits.

First, they eliminate intermediaries. In conventional agreements, brokers, lawyers, notaries, or banks often facilitate enforcement, introducing delays, costs, and potential biases. Smart contracts enable direct, peer-to-peer execution, reducing transaction fees and time. For instance, payments can release automatically upon delivery confirmation, bypassing escrow services.

Second, they enhance security and trust. Blockchain encryption makes records difficult to hack, as altering one requires changing the entire chain. Immutability prevents post-agreement modifications, while transparency allows all parties to verify terms and actions, minimizing disputes.

Third, automation streamlines workflows. Complex stipulations can be programmed, triggering sequential actions without manual oversight. This efficiency is particularly valuable in high-volume or repetitive processes.

Fourth, accessibility broadens participation. Parties can transact globally without shared trust or geographic proximity, fostering inclusion in underserved regions.

These advantages translate to cost savings, faster settlements, and reduced fraud. Studies and implementations show smart contracts cutting enforcement costs significantly, with projections estimating the market growing from hundreds of millions to billions by the early 2030s.

Real-World Applications and Use Cases

Smart contracts have moved beyond theory into diverse industries, demonstrating their practical impact.

In finance, decentralized finance (DeFi) protocols like lending platforms (e.g., Aave) and decentralized exchanges (e.g., Uniswap) rely on smart contracts for automated borrowing, lending, and swapping without banks. Users deposit collateral, and contracts handle interest calculations and liquidations algorithmically.

Supply chain management benefits from traceability: contracts track goods in real-time, releasing payments upon verified milestones, such as shipment arrival detected by sensors. This reduces disputes and optimizes inventory.

Insurance uses parametric contracts, where payouts trigger automatically based on oracle data, like drought measurements for crop insurance in developing regions.

Real estate streamlines transfers by automating title deeds and escrow, potentially shortening closings from months to days.

Non-fungible tokens (NFTs) for digital art and collectibles enforce royalties and ownership via standards like ERC-721.

Healthcare secures patient records, granting access only under specified conditions, while gaming and voting systems ensure fair, tamper-proof mechanics.

As of late 2025, trends include tokenization of real-world assets (RWAs), such as property or commodities, and integration with IoT for automated device interactions.

Challenges and Limitations

Despite their promise, smart contracts face hurdles. Code vulnerabilities have led to high-profile exploits, with billions lost historically due to bugs like reentrancy attacks. Immutability is a double-edged sword: errors in deployment are permanent and costly to mitigate.

Scalability remains an issue on networks like Ethereum, though layer-2 solutions and alternatives like Solana address this with higher throughput.

Oracle dependency introduces risks if data feeds are inaccurate or manipulated. Legal enforceability varies by jurisdiction; courts increasingly apply traditional contract principles, but gaps persist in handling off-chain events or disputes.

Complexity in programming demands expertise, and regulatory uncertainty, including privacy concerns, slows enterprise adoption.

The Future Outlook

Looking ahead from late 2025, smart contracts are poised for explosive growth. Integration with artificial intelligence promises adaptive contracts that optimize terms dynamically or detect anomalies. Cross-chain interoperability will enable seamless operations across blockchains, while zero-knowledge proofs enhance privacy.

Enterprise adoption is accelerating in regulated sectors, with hybrid models blending code and legal text. Market forecasts predict sustained double-digit growth, driven by DeFi maturation, RWA tokenization, and broader blockchain infrastructure.

Ultimately, smart contracts matter because they redefine trust in a digital age. By automating enforcement with code as law, they promise a more efficient, equitable, and decentralized world, reducing reliance on centralized institutions while empowering individuals and businesses alike. As technology matures and risks are mitigated, their influence will only deepen, reshaping commerce, governance, and beyond.