In today’s fast-paced world, where consumerism often dictates our choices, the way we spend our money can profoundly impact our overall happiness. Many people chase material possessions in the belief that they will bring fulfillment, only to find themselves trapped in a cycle of temporary highs followed by lasting dissatisfaction. However, adopting mindful spending habits can lead to a more joyful and contented life. This article explores various strategies for managing your finances in ways that prioritize well-being over mere accumulation. By shifting focus from quantity to quality, from impulse to intention, you can align your spending with your values and long-term happiness.

Understanding the Connection Between Money and Happiness

Research in positive psychology and behavioral economics has long examined how money influences happiness. Studies, such as those from the Harvard Grant Study, suggest that while money can buy comfort up to a certain point, beyond basic needs, it’s the quality of relationships and experiences that truly enhance life satisfaction. For instance, earning enough to cover essentials like housing, food, and healthcare is crucial, but once those are met, additional income has diminishing returns on happiness.

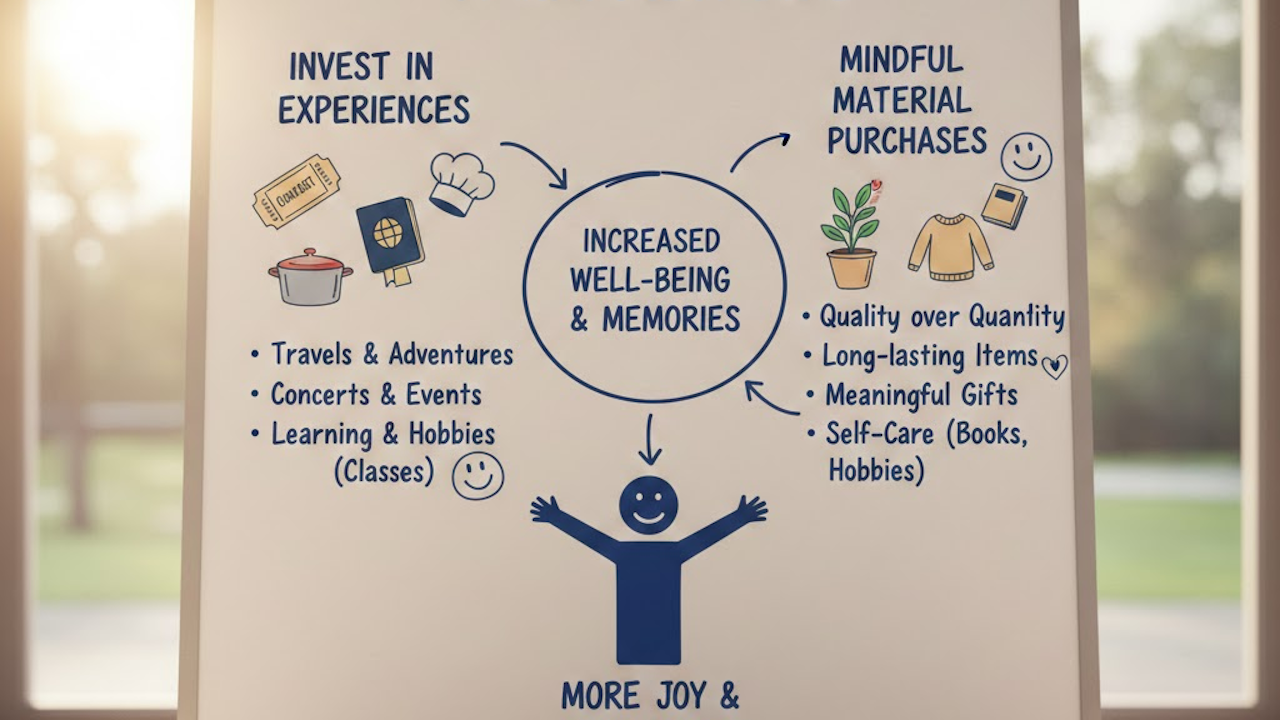

The key lies in how you allocate your resources. Spending on things that foster personal growth, strengthen bonds with others, or provide meaningful experiences tends to yield greater emotional rewards than splurging on fleeting luxuries. Consider the concept of “hedonic adaptation,” where we quickly get used to new possessions, leading to a constant need for more. By contrast, intentional spending habits help break this cycle, promoting sustained joy through thoughtful financial decisions.

Habit 1: Create a Mindful Budget

The foundation of happier spending starts with a budget that reflects your priorities. A mindful budget is not about restriction; it’s about empowerment. Begin by tracking your expenses for a month to identify where your money goes. Tools like spreadsheets or apps can help categorize spending into needs, wants, and savings.

Once you have a clear picture, allocate funds based on what brings you genuine happiness. For example, if family time is important, budget more for shared activities like vacations or home-cooked meals rather than individual gadgets. Set aside a portion for “joy spending,” a small fund for guilt-free treats that align with your values, such as books for a avid reader or art supplies for a creative soul.

Regularly review and adjust your budget. Life changes, and so should your financial plan. This habit fosters a sense of control, reducing stress from financial uncertainty. People who budget mindfully often report lower anxiety levels, as they feel prepared for both expected and unexpected expenses.

Habit 2: Prioritize Experiences Over Material Goods

One of the most transformative spending habits is choosing experiences over things. Psychological research, including work by Thomas Gilovich at Cornell University, shows that experiential purchases like travel, concerts, or classes provide longer-lasting happiness than material ones. Experiences become part of our identity, creating memories that we revisit and share, while objects often lose their appeal over time.

Imagine saving for a weekend getaway with friends instead of buying the latest smartphone. The trip might involve laughter, new discoveries, and strengthened relationships, all of which contribute to emotional well-being. In contrast, the phone might offer initial excitement but soon blends into daily routine.

To implement this, make a list of experiences you’ve always wanted to try, such as learning a new skill or exploring a nearby town. Allocate a monthly “experience fund” to make these happen. Even small experiences, like a picnic in the park or a cooking class, can boost happiness without breaking the bank. Over time, this shift reduces clutter in your life and home, leading to a simpler, more satisfying existence.

Habit 3: Curb Impulse Buying

Impulse purchases are a common pitfall that can derail financial happiness. That sudden urge to buy something unnecessary often stems from emotional triggers like stress, boredom, or social media influence. To combat this, adopt the “24-hour rule”: when tempted by a non-essential item, wait a full day before deciding. This pause allows the initial excitement to fade, revealing whether the purchase truly adds value.

Another strategy is to unsubscribe from marketing emails and limit exposure to advertising. Social media platforms are designed to showcase curated lifestyles, fueling comparison and desire. By curating your feeds to include inspiring but non-commercial content, you reduce the pressure to spend.

Track your impulse buys and reflect on them. Ask yourself: Did this purchase make me happier in the long run? Often, the answer is no, which reinforces better habits. Over time, curbing impulses frees up money for more meaningful uses, enhancing your sense of financial freedom and self-control.

Habit 4: Invest in Health and Personal Development

Spending on health and education is an investment in your future happiness. Physical well-being directly affects mood, energy, and resilience. Allocate funds for nutritious food, gym memberships, or wellness activities like yoga. Preventive care, such as regular check-ups or quality sleep aids, can prevent costly health issues down the line.

Similarly, personal development through books, courses, or workshops builds skills and confidence. Learning a new language or instrument not only provides enjoyment but also opens doors to new opportunities and social connections. Consider the return on investment: a course that leads to a promotion or hobby that brings daily joy far outweighs short-term splurges.

Balance is key. Don’t overspend on trendy wellness fads; focus on sustainable choices. For example, cooking healthy meals at home can be both cost-effective and rewarding. This habit cultivates a proactive approach to life, where you’re not just reacting to problems but actively building a happier, healthier self.

Habit 5: Practice Generous Giving

Generosity is a powerful spending habit linked to happiness. Acts of giving, whether through donations, gifts, or helping others, activate brain regions associated with pleasure and reward. Studies from the University of British Columbia indicate that spending money on others can increase happiness more than spending on oneself.

Start small: buy coffee for a colleague, donate to a cause you care about, or volunteer time (which often involves incidental spending). Set a “giving budget” each month, perhaps 5-10% of your income, directed toward charities or community support. This not only helps others but also fosters a sense of purpose and connection.

Be mindful of your motivations. True generosity comes from empathy, not obligation or expectation of return. Over time, this habit shifts your perspective from scarcity to abundance, reminding you of the positive impact you can have. Many find that giving enhances gratitude for their own circumstances, amplifying personal happiness.

Habit 6: Save and Invest for Security and Freedom

While spending mindfully is important, saving and investing provide the security that underpins long-term happiness. Financial stress is a major happiness killer, so building an emergency fund covering 3-6 months of expenses is essential. This buffer allows you to weather life’s uncertainties without panic.

Beyond saving, consider investing in assets that grow over time, such as stocks, bonds, or retirement accounts. Educate yourself through reliable resources to make informed decisions. The goal is financial independence, where money works for you, granting freedom to pursue passions without constant worry.

Automate your savings to make it effortless. Treat it as a non-negotiable expense, like paying a bill to your future self. This habit builds discipline and peace of mind, knowing you’re prepared for retirement, travel, or unexpected opportunities. People with solid savings often report higher life satisfaction, as they feel empowered rather than constrained by finances.

Overcoming Common Challenges

Adopting these habits isn’t always easy. Societal pressures, peer influence, and economic fluctuations can test your resolve. To stay on track, surround yourself with like-minded individuals or join communities focused on mindful living. Track progress in a journal, noting how new habits affect your mood and relationships.

If debt is an issue, prioritize paying it off while incorporating small happiness-boosting spends. Remember, change is gradual; start with one habit and build from there. Professional advice from financial planners can provide personalized guidance, ensuring your strategies align with your unique situation.

Conclusion: Building a Life of Intentional Joy

Incorporating these spending habits can transform your relationship with money, turning it from a source of stress into a tool for happiness. By budgeting mindfully, prioritizing experiences, curbing impulses, investing in health and growth, giving generously, and saving wisely, you create a financial framework that supports a fulfilling life.

Happiness isn’t about how much you have but how you use it. As you implement these practices, you’ll likely notice improved relationships, reduced anxiety, and a deeper sense of purpose. Start today with a small step, and watch as your spending choices pave the way for a brighter, more joyful tomorrow.