Introduction to Gas Fees in the Crypto World

In the vast and dynamic ecosystem of cryptocurrencies, gas fees represent a fundamental yet often frustrating aspect of blockchain transactions. These fees are essential for the operation of many blockchain networks, particularly those like Ethereum, which rely on them to process and validate transactions. Gas fees ensure that the network remains secure, efficient, and resistant to spam or malicious activities. However, they can sometimes surge dramatically, leading to high costs for users and sparking debates about scalability and usability in the crypto space.

This article delves deeply into the mechanics of gas fees, exploring their origins, how they function, and the various factors that cause them to spike. By understanding these elements, users can better navigate the cryptocurrency landscape, make informed decisions, and potentially mitigate the impact of high fees on their activities. Whether you are a newcomer to crypto or an experienced trader, grasping gas fees is crucial for engaging with decentralized applications (dApps), non-fungible tokens (NFTs), decentralized finance (DeFi), and more.

The Basics: What Are Gas Fees?

At its core, a gas fee is the cost associated with executing operations on a blockchain network. The term “gas” originates from Ethereum, where it metaphorically represents the “fuel” needed to power computations on the Ethereum Virtual Machine (EVM). Every action on the blockchain, from sending Ether (ETH) to another wallet to interacting with smart contracts, requires a certain amount of computational work. This work is measured in units called “gas.”

Gas fees are not unique to Ethereum; similar concepts exist in other blockchains. For instance, Bitcoin uses transaction fees based on the size of the transaction in bytes, while networks like Solana employ a different model with fixed fees per signature. However, Ethereum’s gas system has become the de facto standard for discussing fees in the context of smart contract platforms, and it influences many layer-2 solutions and alternative chains.

To break it down, gas fees serve multiple purposes:

- Incentivizing Validators or Miners: In proof-of-work (PoW) systems like pre-Merge Ethereum or Bitcoin, miners are rewarded with fees for including transactions in blocks. In proof-of-stake (PoS) systems, like post-Merge Ethereum, validators receive these fees as compensation for securing the network.

- Preventing Network Abuse: By requiring users to pay for computational resources, gas fees deter spam attacks, such as denial-of-service (DoS) attempts where an attacker floods the network with meaningless transactions.

- Prioritizing Transactions: Higher fees allow users to prioritize their transactions, ensuring faster confirmation times during periods of congestion.

Without gas fees, blockchains could become overwhelmed, leading to inefficiencies or vulnerabilities. They are a market-driven mechanism that balances supply (network capacity) and demand (user activity).

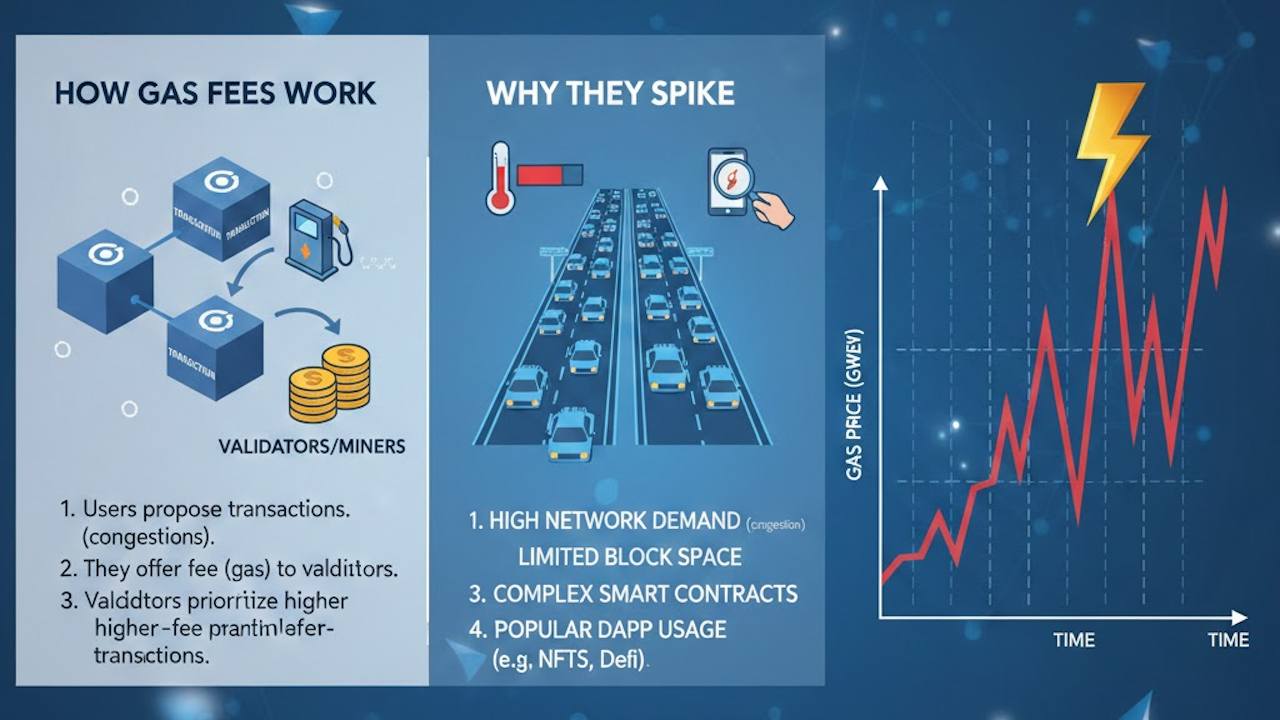

How Gas Fees Work: A Step-by-Step Breakdown

To understand gas fees, it is helpful to dissect the process of a typical transaction on Ethereum, as it provides a clear model that many other chains emulate.

Step 1: Measuring Gas Usage

Every operation on the EVM has a predefined gas cost. Simple actions, like transferring ETH, might require around 21,000 gas units. More complex interactions, such as executing a smart contract for swapping tokens on a decentralized exchange (DEX) like Uniswap, can consume hundreds of thousands of gas units. These costs are fixed and documented in Ethereum’s yellow paper, ensuring predictability in terms of computation.

For example:

- A basic ETH transfer: 21,000 gas.

- Approving a token spend: Approximately 46,000 gas.

- Swapping tokens on a DEX: 100,000 to 200,000 gas, depending on the complexity.

The total gas used for a transaction is the sum of all operations performed.

Step 2: Setting the Gas Price

Users specify a “gas price,” which is the amount they are willing to pay per unit of gas. Historically, this was denoted in Gwei (1 Gwei = 0.000000001 ETH). For instance, if a transaction requires 100,000 gas and the user sets a gas price of 50 Gwei, the total fee would be 100,000 * 50 Gwei = 0.005 ETH.

Ethereum’s London Upgrade in 2021 introduced EIP-1559, which reformed this system. Now, fees consist of:

- Base Fee: A network-determined fee per gas unit, burned (removed from circulation) to reduce ETH supply and create deflationary pressure.

- Priority Fee (Tip): An optional tip to validators to incentivize quicker inclusion.

The total fee is (base fee + priority fee) * gas used. This makes fees more predictable, as wallets can estimate the base fee based on recent blocks.

Step 3: Gas Limits and Refunds

Users also set a “gas limit,” which is the maximum gas they are willing to consume. If a transaction exceeds this limit (e.g., due to an infinite loop in a smart contract), it fails, but the user still pays for the gas used up to that point. Unused gas is refunded, adding a layer of protection.

On a network level, each block has a gas limit (e.g., Ethereum’s is around 30 million gas per block), capping the total computations per block and influencing overall throughput.

Step 4: Transaction Inclusion and Confirmation

Transactions enter a mempool (memory pool), where validators select them based on fee profitability. Higher-paying transactions are prioritized. Once included in a block and added to the blockchain, the transaction is confirmed, and fees are distributed (or burned, in the case of base fees).

This process ensures decentralization: No central authority dictates fees; it is a free market driven by users and validators.

Why Gas Fees Spike: Key Factors and Triggers

While gas fees are designed to be efficient, they can skyrocket during periods of high demand, sometimes reaching hundreds of dollars per transaction. Understanding the causes of these spikes is essential for anticipating and avoiding them.

1. Network Congestion

The primary driver of fee spikes is congestion, which occurs when more transactions are submitted than the network can process. Ethereum, for example, processes about 15 to 30 transactions per second (TPS), far below traditional systems like Visa (thousands of TPS). When demand exceeds this capacity, users bid higher fees to jump the queue.

Congestion often stems from viral events:

- DeFi Booms: In 2020’s “DeFi Summer,” platforms like Compound and Uniswap saw explosive growth. Yield farming, where users lock assets to earn rewards, led to millions of transactions, pushing average gas prices above 100 Gwei.

- NFT Mania: The 2021 NFT craze, exemplified by collections like CryptoPunks and Bored Ape Yacht Club, caused massive spikes. Minting an NFT could cost over $100 in fees during peaks, as thousands competed for block space.

- Airdrops and Token Launches: Projects distributing free tokens (airdrops) or launching initial DEX offerings (IDOs) attract bots and users racing to claim or trade, overwhelming the network.

2. Market Volatility

Crypto markets are notoriously volatile. During bull runs, increased trading activity on DEXes spikes fees. For instance, when ETH prices surge, more users interact with protocols, amplifying demand. Conversely, flash crashes or panic selling can also cause temporary spikes as users rush to exit positions.

3. Smart Contract Complexity

Complex dApps require more gas. If a popular protocol updates with gas-intensive features, or if exploits occur (e.g., flash loan attacks), it can indirectly raise fees by increasing overall network load.

4. External Events and Influences

Global events play a role:

- Regulatory News: Announcements like China’s crypto bans or U.S. SEC rulings can trigger mass movements of funds.

- Hacks and Security Incidents: After major hacks, such as the Ronin Bridge exploit in 2022, users flock to secure their assets, spiking fees.

- Layer-1 Limitations: Blockchains with low TPS inherently face spikes more often. Ethereum’s upgrades, like The Merge (to PoS) and sharding plans, aim to address this, but until fully implemented, spikes persist.

5. Speculative Behavior and Bots

Automated bots exacerbate spikes by front-running transactions (e.g., in DEX trades) or arbitraging opportunities, submitting high-fee transactions rapidly. This creates a feedback loop where human users must outbid bots.

Historical examples illustrate these spikes vividly. In May 2021, during the height of the bull market, Ethereum gas fees averaged over 200 Gwei, with peaks at 1,500 Gwei. More recently, in late 2024, a surge in layer-2 adoption temporarily alleviated mainnet pressure, but events like major Ordinals inscriptions on Bitcoin (which uses a fee market for data inscription) showed similar dynamics on other chains.

Consequences of High Gas Fees

Spiking fees have broader implications:

- User Exclusion: High costs alienate retail users, favoring whales (large holders) and institutions.

- Network Centralization: Persistent high fees might drive users to centralized alternatives, undermining decentralization.

- Innovation Barriers: Developers hesitate to build gas-heavy dApps, stifling creativity.

On the positive side, spikes highlight scalability needs, accelerating solutions like layer-2 rollups (e.g., Optimism, Arbitrum) that batch transactions off-chain for cheaper processing.

Strategies to Mitigate and Avoid High Gas Fees

While spikes are inevitable, users can employ tactics to minimize costs:

- Timing Transactions: Monitor tools like Etherscan or GasNow for low-congestion periods, often late nights or weekends in UTC.

- Layer-2 Solutions: Use rollups or sidechains like Polygon, which offer Ethereum-compatible environments with fees under $0.01.

- Wallet Optimizations: Modern wallets like MetaMask suggest optimal fees and allow custom settings. Batch transactions where possible to amortize costs.

- Alternative Blockchains: Chains like Binance Smart Chain (BSC), Solana, or Avalanche offer lower fees due to higher throughput, though with trade-offs in decentralization.

- Gas-Efficient Practices: Developers can optimize contracts (e.g., using assembly code), and users can choose simpler protocols.

Future upgrades, such as Ethereum’s Danksharding (expected in 2026), promise to increase data availability and reduce fees dramatically.

Conclusion: The Evolving Role of Gas Fees in Crypto

Gas fees are the lifeblood of blockchain networks, ensuring security and efficiency in a decentralized manner. However, their tendency to spike underscores the growing pains of the crypto industry as it scales to accommodate billions of users. From Ethereum’s foundational model to innovations across the multichain landscape, understanding gas fees empowers participants to thrive amid volatility.

As the sector matures, with advancements in sharding, zero-knowledge proofs, and modular blockchains, we can anticipate a future where high fees become relics of the past. Until then, staying informed and adaptable remains key to navigating this exciting frontier. Whether trading, investing, or building, gas fees remind us that in crypto, every action has a cost, but also a value in fostering a trustless global economy.