Cryptocurrency and blockchain technology have revolutionized the way we think about money, transactions, and decentralized systems. However, as these networks grow in popularity, they face significant challenges, particularly in terms of scalability. If you’re new to crypto, you might have heard terms like “Layer 1” and “Layer 2,” but understanding what they mean and why they matter can seem daunting. This article aims to break down Layer 2 solutions in a simple, step-by-step manner. We’ll explore what they are, why they’re needed, the different types available, real-world examples, and their potential future impact. By the end, you’ll have a solid grasp of how Layer 2 is helping to make blockchain more efficient and accessible for everyone.

Understanding the Basics: What is Blockchain and Its Layers?

To appreciate Layer 2 solutions, we first need to understand the foundation: blockchain itself. A blockchain is essentially a digital ledger that records transactions across a network of computers in a secure, transparent, and immutable way. Popular blockchains like Bitcoin and Ethereum are what we call Layer 1 networks. These are the base layers where all the core operations happen, including consensus mechanisms (like proof-of-work or proof-of-stake) that validate transactions and maintain security.

Layer 1 blockchains handle everything from transaction processing to smart contract execution. However, they have inherent limitations. For instance, Bitcoin can process about 7 transactions per second (TPS), while Ethereum manages around 15 to 30 TPS. Compare that to traditional payment systems like Visa, which handle thousands of TPS, and you see the problem. As more users join these networks, congestion builds up, leading to slow transaction times and high fees. This is often referred to as the “scalability trilemma,” where blockchains struggle to balance decentralization, security, and scalability simultaneously.

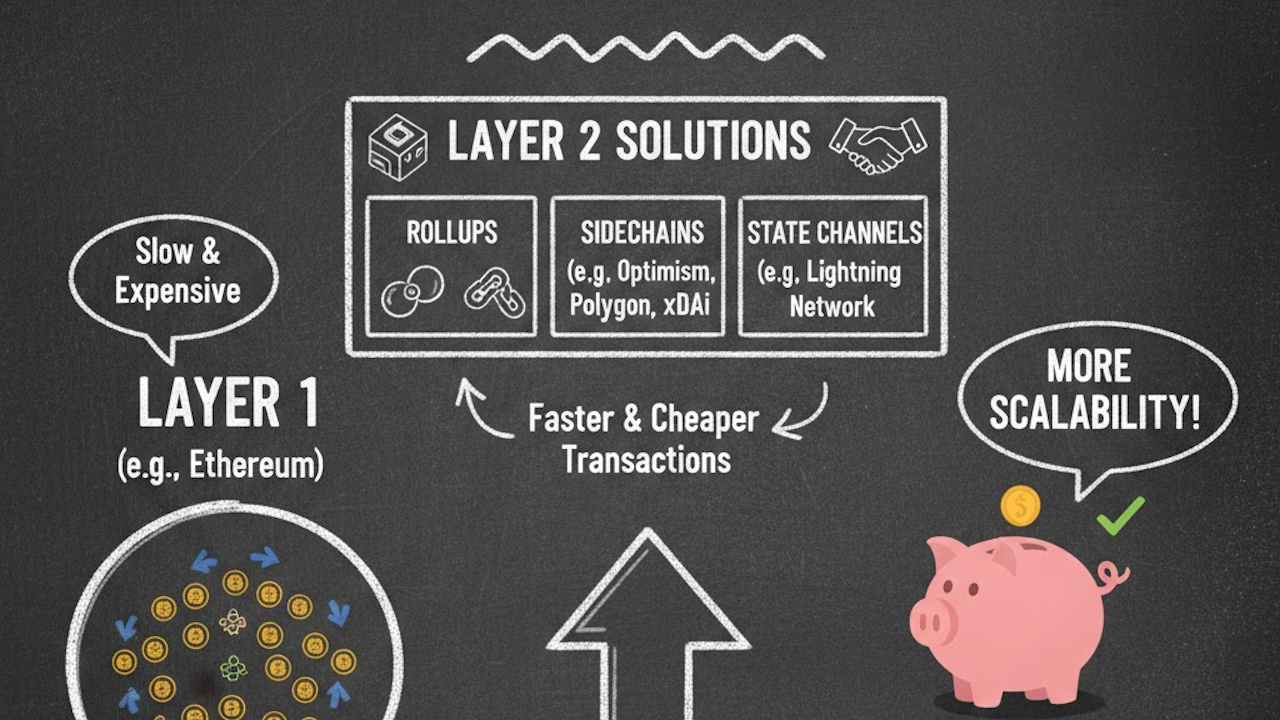

This is where Layer 2 comes in. Layer 2 solutions are protocols built on top of Layer 1 blockchains to enhance their performance without altering the underlying structure. Think of Layer 1 as the highway foundation and Layer 2 as additional lanes or overpasses that allow more traffic to flow efficiently. These solutions offload some of the workload from the main chain, processing transactions faster and cheaper while still relying on Layer 1 for security and final settlement.

Why Do We Need Layer 2 Solutions?

The primary reason for Layer 2 is to address the scalability issues plaguing Layer 1 blockchains. As crypto adoption surges, networks like Ethereum have experienced “gas wars,” where users compete to have their transactions processed by paying higher fees. During peak times, such as major NFT drops or DeFi booms, fees can skyrocket to tens or even hundreds of dollars per transaction. This makes the network impractical for everyday use, like buying a coffee or sending small amounts of money.

Layer 2 solutions aim to solve this by enabling thousands or even millions of TPS at a fraction of the cost. They achieve this through various techniques that bundle transactions, process them off-chain, and then settle them back on the main chain. Importantly, Layer 2 maintains the decentralization and security of the base layer, ensuring that users don’t sacrifice trust for speed. For beginners, this means you can enjoy the benefits of blockchain, such as ownership of assets and peer-to-peer transactions, without the frustrations of slow and expensive operations.

Beyond scalability, Layer 2 also promotes innovation. It allows developers to build more complex applications, like decentralized finance (DeFi) platforms, gaming ecosystems, and non-fungible tokens (NFTs), that require frequent interactions. Without Layer 2, these applications would be too costly for widespread use, limiting the potential of Web3, the next evolution of the internet built on blockchain.

Types of Layer 2 Solutions

There are several approaches to Layer 2, each with its own mechanics, advantages, and trade-offs. We’ll cover the most common ones here, explaining them in simple terms.

State Channels

State channels are like private chat rooms for transactions. They allow two or more parties to conduct multiple transactions off-chain, only settling the final state on the main blockchain. Imagine you and a friend are playing a game where you bet small amounts of crypto each round. Instead of recording every bet on the blockchain (which would be expensive), you open a state channel, track all the bets privately, and only post the net result when you’re done.

The Lightning Network on Bitcoin is a prime example of state channels. It enables instant, low-cost Bitcoin payments by creating payment channels between users. Pros include near-instant transactions and minimal fees. However, cons are that they work best for frequent interactions between the same parties and require participants to be online to monitor the channel.

Plasma

Plasma is an older Layer 2 framework, often described as “child chains” that run alongside the main chain. These child chains handle their own transactions and periodically commit summaries back to the parent chain (Layer 1). It’s like having smaller, specialized ledgers that offload work but still anchor to the secure base.

Plasma was pioneered for Ethereum but has evolved into more advanced forms. One key feature is fraud proofs, where users can challenge invalid transactions on the child chain. While Plasma offers high scalability, it has challenges like data availability issues (ensuring all transaction data is accessible) and complex exit mechanisms when users want to withdraw funds back to Layer 1. It’s less commonly used today, having been somewhat superseded by rollups.

Rollups

Rollups are currently the most popular and promising Layer 2 solutions, especially for Ethereum. They “roll up” or bundle hundreds of transactions into a single one, which is then posted to the main chain. This reduces the data load on Layer 1 while inheriting its security. There are two main types: Optimistic Rollups and Zero-Knowledge (ZK) Rollups.

- Optimistic Rollups: These assume all transactions in the bundle are valid by default (hence “optimistic”). If someone suspects fraud, they can submit a challenge during a dispute window (usually about a week). If proven invalid, the bad transaction is rolled back. Examples include Optimism and Arbitrum. Pros: High throughput (up to thousands of TPS), low costs, and easy compatibility with Ethereum smart contracts. Cons: The challenge period can delay finality, meaning withdrawals take time.

- ZK Rollups: These use cryptographic proofs called zero-knowledge proofs to verify the entire bundle instantly without revealing details. It’s like proving you know a secret without saying what it is. ZK Rollups, such as those from zkSync or Polygon zkEVM, offer immediate finality and stronger privacy. Pros: Faster settlements and enhanced security. Cons: More computationally intensive, which can make them slightly more expensive to operate, though still cheaper than Layer 1.

Sidechains

Sidechains are independent blockchains that run parallel to the main chain and are connected via bridges. They have their own consensus mechanisms and can process transactions autonomously. Funds are transferred between the main chain and sidechain through locking and unlocking mechanisms.

Polygon (formerly Matic) is a well-known sidechain for Ethereum, offering fast and cheap transactions for dApps. Pros: High flexibility and scalability. Cons: They don’t inherit the full security of Layer 1, relying on their own validators, which could be a vulnerability if the sidechain is compromised.

Real-World Examples and Applications

To make this more concrete, let’s look at some prominent Layer 2 projects.

- Lightning Network (Bitcoin): As mentioned, this state channel solution has enabled microtransactions for Bitcoin. It’s used in apps for remittances, gaming, and even social media tipping. By 2026, it has grown significantly, with billions in locked value.

- Arbitrum and Optimism (Ethereum): These Optimistic Rollups power many DeFi protocols and NFT marketplaces. For beginners, using them means interacting with Ethereum dApps like Uniswap at a fraction of the cost. Arbitrum, for instance, has its own token (ARB) for governance.

- Polygon: As a sidechain with rollup capabilities, Polygon hosts popular games like Decentraland and Aavegotchi. It’s beginner-friendly with tools like the Polygon Wallet for easy onboarding.

- zkSync and Loopring: ZK Rollup examples that excel in trading and payments. Loopring, focused on decentralized exchanges, allows users to trade without high fees.

These solutions are not just theoretical; they’re live and handling real value. For example, during Ethereum’s transition to proof-of-stake (The Merge in 2022), Layer 2 adoption surged, reducing mainnet congestion.

Advantages and Disadvantages of Layer 2

Layer 2 brings numerous benefits:

- Cost Efficiency: Transactions can cost pennies instead of dollars.

- Speed: Near-instant confirmations compared to minutes or hours on Layer 1.

- Scalability: Supports mass adoption without overwhelming the base chain.

- Interoperability: Many Layer 2s are EVM-compatible, meaning they work seamlessly with Ethereum tools.

However, there are drawbacks:

- Complexity: Beginners might find bridging funds between layers confusing.

- Security Risks: While most inherit Layer 1 security, bugs in bridges have led to hacks (e.g., the Ronin Bridge incident in 2022).

- Fragmentation: Multiple Layer 2s can create silos, making it hard to move assets fluidly.

- Centralization Concerns: Some solutions rely on fewer validators, potentially compromising decentralization.

The Future of Layer 2 Solutions

Looking ahead, Layer 2 is poised to become the standard for blockchain interactions. With Ethereum’s ongoing upgrades, like danksharding, Layer 2 will handle even more data efficiently. We might see “Layer 3” applications built on top of Layer 2 for hyper-specific use cases, like privacy-focused networks.

Cross-chain bridges and interoperability protocols, such as those from Cosmos or Polkadot, could unify these layers. For beginners, this means easier access to crypto: imagine seamless payments across Bitcoin, Ethereum, and beyond. Regulatory clarity will also play a role, as governments address scalability in their frameworks.

In conclusion, Layer 2 solutions are the key to unlocking blockchain’s full potential. They make crypto practical for everyday use while preserving its core principles. If you’re just starting, experiment with a Layer 2 wallet on testnets to see the difference. As the technology evolves, staying informed will help you navigate this exciting space. Whether you’re investing, building, or just curious, understanding Layer 2 is a great step toward mastering cryptocurrency.