The cryptocurrency market has exploded in popularity over the past decade, drawing in millions of traders eager to capitalize on the promise of quick riches. Bitcoin, Ethereum, and countless altcoins have created overnight millionaires, but the harsh reality is that the vast majority of participants end up losing money. Studies and industry data consistently show that around 90 to 95 percent of crypto traders fail to turn a profit in the long run. This statistic is not unique to crypto; similar figures appear in traditional day trading and forex markets, where up to 97 percent of persistent traders in some regions, like Brazil, lose money over extended periods. So, why does this happen? The reasons are multifaceted, stemming from behavioral pitfalls, market dynamics, and a lack of preparation. In this article, we will explore the primary factors contributing to these widespread losses, drawing on insights from experts, research, and real-world observations to provide a comprehensive understanding.

The Illusion of Easy Money: Lack of Education and Preparation

One of the most fundamental reasons crypto traders lose money is a sheer lack of education. Many newcomers enter the market enticed by stories of massive gains, often amplified on social media platforms like X (formerly Twitter), without understanding the basics of blockchain technology, market analysis, or trading principles. They treat crypto trading like a lottery, buying coins based on hype rather than informed decisions. Without knowledge of technical analysis, such as reading candlestick charts or identifying support and resistance levels, traders are essentially gambling.

Research indicates that this problem is exacerbated by the speculative nature of cryptocurrencies. Unlike traditional stocks, which are backed by company earnings and assets, many cryptos have little intrinsic value and are driven purely by sentiment and speculation. A study on day trading and crypto investing highlights how individuals often exhibit gambling-like behaviors, including impulsivity and novelty-seeking, which lead to higher financial losses. Beginners frequently ignore the importance of learning about wallet security, exchange fees, and tax implications, leading to unexpected costs that erode any potential profits.

Moreover, the rapid evolution of the crypto space means that even seasoned traders must stay updated. New protocols, like decentralized finance (DeFi) or non-fungible tokens (NFTs), introduce complexities that unprepared traders cannot navigate. As one X user pointed out in a recent thread, “99% of crypto traders lose money” due to emotions running high during volatile periods, without the foundational knowledge to manage risks. To succeed, traders need to invest time in education, perhaps through reputable courses or books, before risking capital.

Emotional Trading: The Grip of Fear and Greed

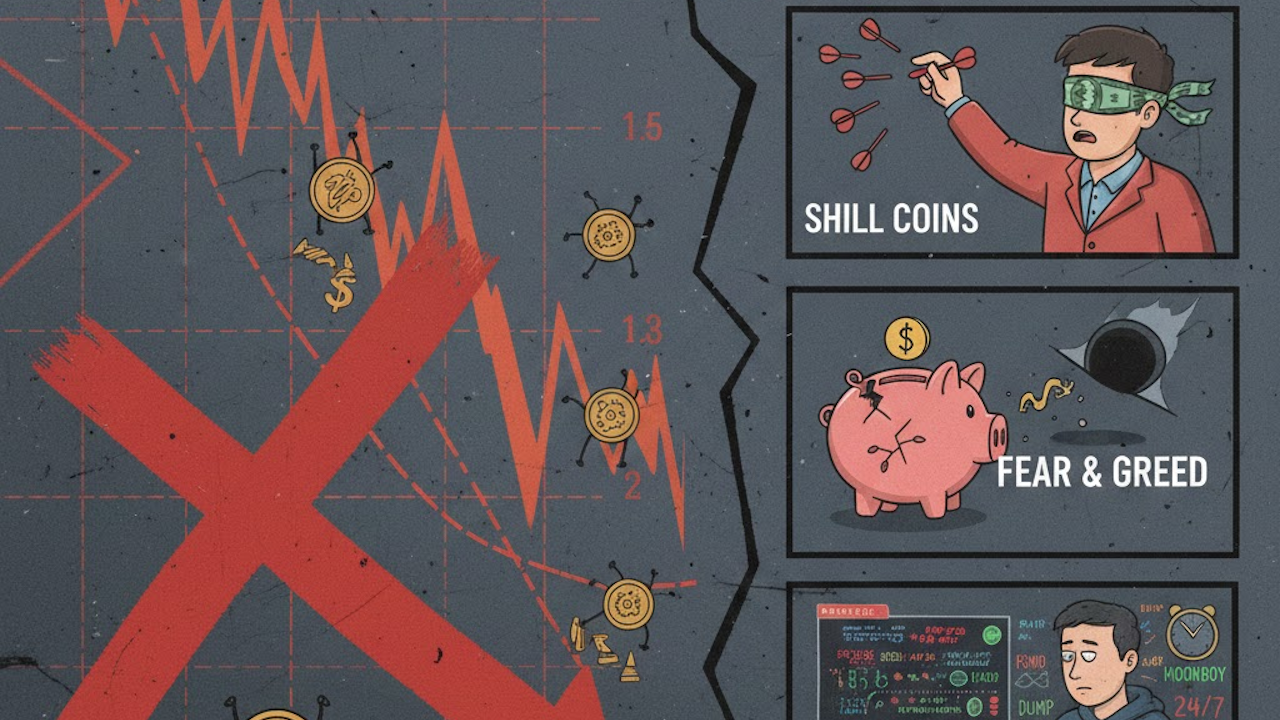

Emotions are the silent killer in crypto trading. The market’s extreme volatility amplifies psychological biases, leading traders to make irrational decisions. Fear of missing out (FOMO) drives people to buy at peak prices, while panic selling during dips locks in losses. This cycle is well-documented; for instance, traders often chase rising assets out of greed, only to sell at a loss when the inevitable correction hits.

Psychological studies show that losing traders are more likely to engage in “loss-chasing,” where they double down on failing positions in hopes of recovery, similar to gamblers. In crypto, this is particularly dangerous because prices can swing 10 to 20 percent in a single day. A common scenario is a trader buying Bitcoin at $80,000, watching it drop to $70,000, and selling in fear, only for it to rebound shortly after. Experienced investors emphasize that emotional trading dominates decision-making, with patterns of FOMO leading to consistent losses.

To illustrate, consider the 2021 bull run: Many bought into meme coins like Dogecoin at all-time highs, driven by social media buzz, only to lose heavily in the subsequent crash. Recent X discussions echo this, with users noting that traders promise to buy at certain levels but hesitate when the opportunity arises, perpetuating the loss cycle. Discipline is key; successful traders use rules-based systems to remove emotion from the equation.

Poor Risk Management: Betting the Farm

Risk management is the backbone of profitable trading, yet most crypto enthusiasts ignore it entirely. Without setting stop-loss orders or position sizing appropriately, a single bad trade can wipe out an entire portfolio. Statistics reveal that losing traders often risk more than 1 to 2 percent of their capital per trade, leading to rapid account depletion.

In crypto, where leverage is readily available on exchanges, this issue is magnified. Traders borrow funds to amplify positions, turning small market moves into massive gains or losses. However, as one analysis points out, overleveraging is the “account killer,” with 10x or higher leverage causing liquidations during minor dips. Exchanges like Binance and others push leverage because it increases trading volume and fees, but it disproportionately harms retail traders.

Furthermore, many fail to diversify, putting all eggs in one basket like a single altcoin. When that asset tanks, losses are catastrophic. Proper risk management involves using tools like trailing stops and maintaining a risk-reward ratio of at least 1:2, ensuring wins outweigh losses over time.

Overleveraging and the Lure of Quick Gains

Building on risk management, overleveraging deserves its own spotlight as a top culprit. Crypto exchanges offer up to 100x leverage, allowing traders to control large positions with minimal capital. While this can lead to outsized profits, it more often results in total wipeouts. Data from trading platforms shows that leveraged positions are liquidated en masse during volatility spikes, fueling further price drops.

Why do traders fall for this? The promise of quick riches overrides caution. A small investment can yield huge returns if the market moves favorably, but the opposite is far more common. In fact, studies indicate that frequent traders, especially those using high leverage, have loss rates as high as 80 percent. Smart traders advise sticking to spot trading or low leverage to prioritize survival over speculation.

Chasing Hype and Memecoins: The FOMO Trap

The crypto market thrives on hype, with memecoins like Shiba Inu or newer trends capturing attention overnight. Traders pile in based on social media buzz or influencer endorsements, often without researching the project’s fundamentals. This “chasing” behavior leads to buying at inflated prices, followed by rug pulls or dumps by early investors.

Influencers and signals exacerbate this, as blind following without verification results in losses. As one X post succinctly states, “Blindly following influencers” is a key reason 95 percent lose money. True success comes from due diligence, not hype.

Overtrading: The Cost of Constant Action

Many traders feel the need to be constantly active, executing dozens of trades daily. This overtrading racks up fees and increases error probability. Research shows losing traders place four times more trades than winners, often driven by boredom or the thrill of action.

In crypto, transaction fees on chains or exchanges add up quickly, eroding profits. Patience is a virtue; quality over quantity wins.

Market Volatility and Unpredictability

Crypto’s hallmark is volatility, with prices swinging wildly due to news, regulations, or whale movements. Traders unprepared for this often get caught in sudden downturns, like flash crashes.

Centralized exchanges (CEXs) add layers, with stop-loss hunting and liquidity games favoring the house. Understanding volatility requires tools like volatility indexes, but most ignore them.

Scams, Hacks, and Security Lapses

The unregulated nature of crypto invites fraud. Phishing, rug pulls, and exchange hacks lead to billions in losses annually. Traders storing assets on exchanges risk everything in a breach, as seen in past incidents like FTX.

Using self-custody wallets and verifying projects can mitigate this, but many skip these steps.

No Clear Trading Plan or Exit Strategy

Entering trades without a plan is like sailing without a map. Most losers lack defined entry/exit points or profit targets. This leads to holding losing positions too long or selling winners prematurely.

A solid plan includes backtesting strategies and journaling trades for review.

Psychological Biases and the House Edge

Finally, inherent biases like confirmation bias (seeking info that confirms beliefs) plague traders. Combined with CEX incentives favoring volume over user success, the odds are stacked against retail participants.

Conclusion: Turning the Tide

While most crypto traders lose money due to these interconnected issues, it’s not inevitable. By prioritizing education, discipline, risk management, and a long-term perspective, you can join the profitable minority. Remember, crypto is a marathon, not a sprint. Focus on survival first, and profits will follow. As echoed in trading communities, discipline trumps tools every time.