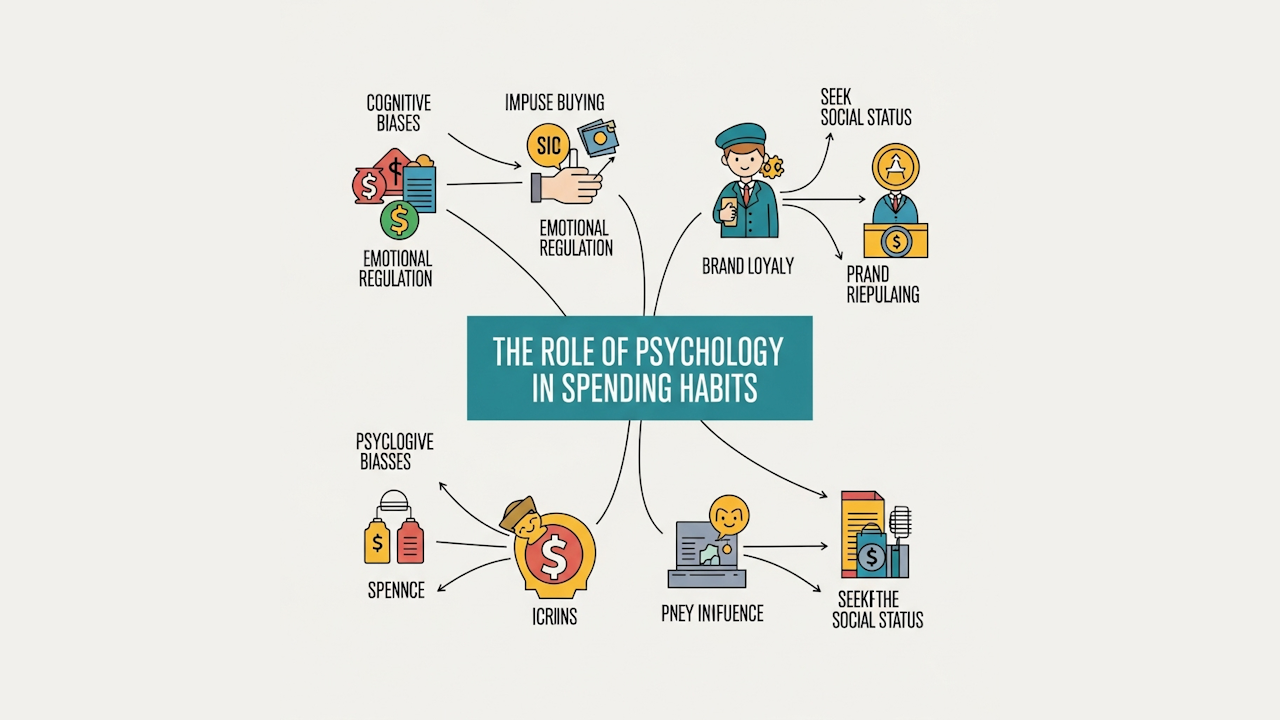

The intricate dance between our minds and our wallets is choreographed by the subtle yet powerful influence of psychology. Understanding this relationship is crucial, not just for individuals seeking financial stability, but also for businesses aiming to understand consumer behavior. The field of psychology illuminates the underlying mechanisms that drive our spending habits, revealing that our choices are rarely purely rational. Instead, they are often swayed by a complex interplay of emotions, cognitive biases, and social pressures.

One of the most significant psychological factors impacting spending is emotion. Our emotional state can profoundly influence our decision-making process. For example, feelings of sadness or stress can lead to impulsive purchases as individuals seek temporary relief or gratification. This phenomenon, often referred to as “retail therapy,” highlights the emotional connection we form with material possessions. Conversely, feelings of happiness or excitement can also trigger spending sprees, as individuals associate purchases with positive experiences. The emotional attachment we develop with brands and products can override logical considerations, leading us to spend more than we initially intended.

Cognitive biases, systematic errors in thinking, also play a substantial role in shaping our spending habits. Anchoring bias, for instance, occurs when we rely too heavily on the first piece of information offered (the “anchor”) when making decisions. In retail, this can manifest as focusing on the original, higher price of an item, making the sale price seem like a bargain, even if it’s still overpriced. Similarly, the scarcity effect, where we perceive items as more valuable when they are limited, can drive us to make hasty purchases out of fear of missing out. The framing effect, which demonstrates how the way information is presented can influence our choices, is another powerful tool used in marketing. For instance, a product presented as “90% fat-free” is often perceived as healthier than one labeled “10% fat,” even though they convey the same information.

Social influences further complicate the picture. Our spending habits are not formed in isolation; they are shaped by the people around us. Social proof, the tendency to follow the actions of others, can lead us to purchase items simply because they are popular or endorsed by influencers. We are also susceptible to peer pressure, particularly in social settings where we may feel compelled to keep up with the spending habits of our friends or colleagues. The desire for social acceptance and status can drive us to make purchases that exceed our financial means, leading to debt and financial instability.

Furthermore, the psychology of reward and reinforcement plays a critical role. The instant gratification associated with making a purchase can trigger the release of dopamine, a neurotransmitter associated with pleasure. This reinforces the behavior, making us more likely to repeat it in the future. Loyalty programs and reward systems capitalize on this principle, offering incentives that encourage repeat purchases and foster brand loyalty. The anticipation of future rewards can be just as powerful as the rewards themselves, creating a cycle of consumption.

The concept of perceived value is also fundamental. It’s not just about the actual cost of an item but also about what it represents to the individual. For some, a luxury brand signifies status and success, while for others, it may represent quality and durability. The emotional and symbolic value we attach to products can significantly influence our willingness to pay for them. Marketers often leverage this by creating compelling brand narratives that resonate with consumers’ values and aspirations.

Finally, the psychology of habit formation is crucial. Many of our spending decisions are not conscious choices but rather ingrained habits that we repeat without much thought. Understanding how habits are formed and broken can be instrumental in developing strategies for managing spending. By identifying triggers that lead to impulsive purchases and replacing them with healthier habits, individuals can gain greater control over their finances.

In essence, psychology provides a lens through which we can understand the multifaceted nature of spending habits. By recognizing the emotional, cognitive, and social factors that influence our choices, we can develop strategies for making more informed and responsible financial decisions. This understanding is not only beneficial for individuals but also for businesses seeking to create ethical and sustainable marketing practices that respect the psychological well-being of consumers.