Planning for retirement may seem distant when you are just starting your career, but it is one of the most crucial financial steps for long-term security. Young professionals have a unique advantage—time. The earlier you begin saving, the more you can benefit from compound interest and long-term market growth. Understanding the best retirement plans available can help you make informed decisions that will pay off in the future.

401(k) Plans

One of the most popular and accessible retirement savings options for young professionals is an employer-sponsored 401(k) plan. Many companies offer these plans to their employees, allowing them to contribute a portion of their salary on a pre-tax basis. This means that contributions reduce your taxable income, providing immediate tax savings.

A key benefit of a 401(k) plan is the employer match. Some employers will match a percentage of your contributions, effectively offering free money toward your retirement. Young professionals should aim to contribute at least enough to take full advantage of the employer match. Since contributions are deducted automatically from your paycheck, it simplifies the process of consistent saving.

Additionally, there are Roth 401(k) options available through some employers. Unlike traditional 401(k) plans, contributions to a Roth 401(k) are made with after-tax dollars. While this does not provide immediate tax savings, withdrawals during retirement are tax-free, including the growth on your investments. This can be particularly advantageous for young professionals who expect to be in a higher tax bracket in the future.

Individual Retirement Accounts (IRAs)

IRAs offer another effective way to save for retirement. There are two main types: Traditional IRAs and Roth IRAs. Both provide unique tax advantages that can benefit young professionals depending on their current and future financial outlook.

A Traditional IRA allows you to contribute pre-tax dollars, which can lower your current taxable income. However, withdrawals during retirement are taxed as ordinary income. This type of IRA is beneficial for those who anticipate being in a lower tax bracket in retirement.

Conversely, a Roth IRA is funded with after-tax dollars, meaning there is no immediate tax deduction. However, qualified withdrawals in retirement are tax-free. This feature makes the Roth IRA especially attractive for young professionals, who may currently be in a lower tax bracket and can take advantage of decades of tax-free growth.

In 2024, the annual contribution limit for both Traditional and Roth IRAs is $7,000, with an additional $1,000 catch-up contribution allowed for individuals aged 50 and older. Young professionals who do not have access to an employer-sponsored plan can still use an IRA to build substantial retirement savings.

Health Savings Accounts (HSAs)

While not traditionally thought of as a retirement plan, a Health Savings Account (HSA) can be a powerful tool for long-term financial security. HSAs are available to individuals enrolled in a high-deductible health plan and offer a triple tax advantage: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free.

What makes an HSA particularly beneficial for young professionals is its flexibility. Unused funds roll over from year to year, and after age 65, you can withdraw funds for any purpose without penalty (though non-medical withdrawals are subject to ordinary income tax). By investing HSA funds, young professionals can build a substantial reserve for healthcare costs in retirement while enjoying tax advantages.

Self-Employed Retirement Plans

For young professionals pursuing freelance work, entrepreneurship, or side businesses, there are specialized retirement plans tailored to self-employed individuals. Two of the most popular options are the Simplified Employee Pension (SEP) IRA and the Solo 401(k).

A SEP IRA allows self-employed individuals to contribute up to 25% of their net earnings, with a maximum contribution limit of $69,000 in 2024. This plan is simple to set up and maintain, making it an attractive option for solo business owners looking to reduce their taxable income while saving for the future.

A Solo 401(k) is another robust option for self-employed professionals. This plan allows both employee and employer contributions, which can lead to higher overall contribution limits. For 2024, the total contribution limit is $69,000, with an additional $7,500 catch-up contribution for those aged 50 or older. The Solo 401(k) can also include a Roth component, providing the same after-tax growth benefits as a Roth IRA.

Taxable Investment Accounts

Although not specifically designed for retirement, taxable investment accounts can play a valuable role in a young professional’s long-term financial plan. These accounts offer greater flexibility, as there are no contribution limits or required minimum distributions. You can invest in a broad range of assets, including stocks, bonds, and mutual funds.

While taxable investment accounts lack the tax advantages of traditional retirement plans, they provide liquidity and the ability to access funds at any time without penalty. For young professionals who have already maxed out their tax-advantaged accounts, these accounts offer an additional avenue for growing wealth.

Employer Stock Purchase Plans (ESPPs)

If your employer offers an ESPP, it can be another avenue for long-term savings. ESPPs allow employees to purchase company stock at a discount, typically ranging from 5% to 15%. While this is not a dedicated retirement plan, it can supplement other savings strategies and potentially provide substantial returns if your company’s stock performs well.

Young professionals should be mindful of diversifying their investments rather than relying too heavily on their employer’s stock. Nevertheless, participating in an ESPP can be a strategic way to enhance your retirement savings.

Key Strategies for Maximizing Retirement Savings

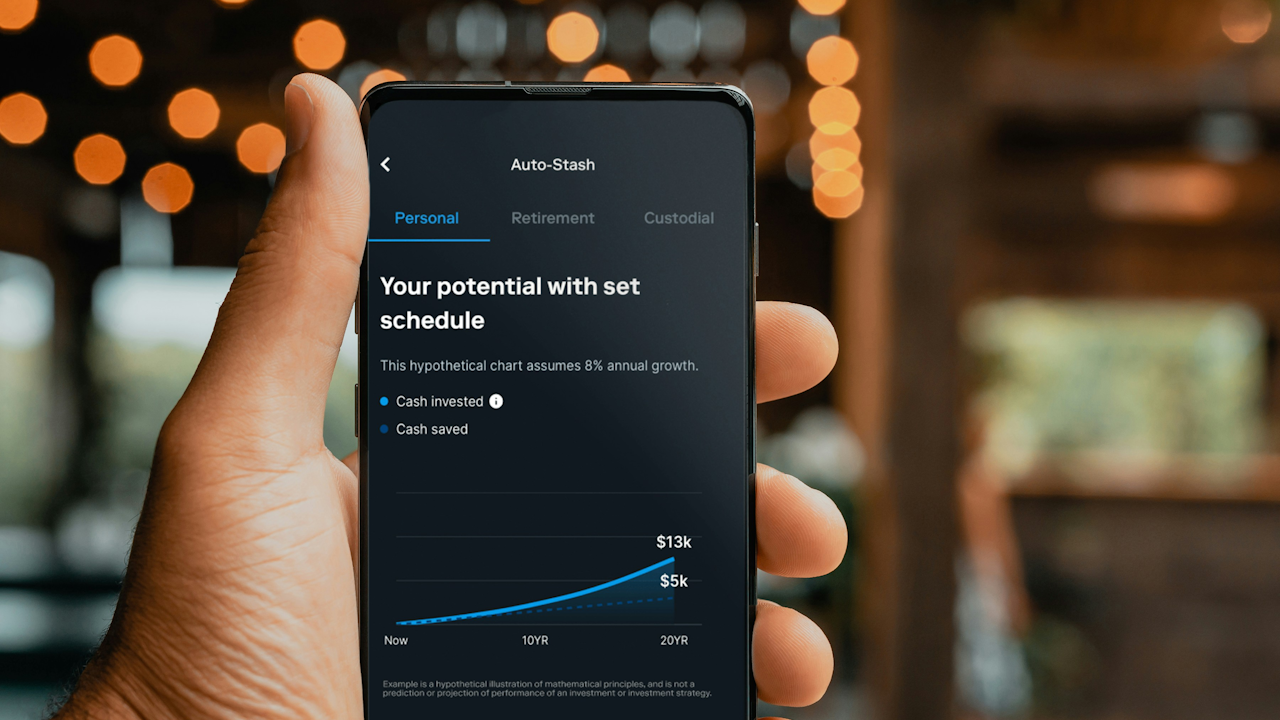

Young professionals can take advantage of several strategies to optimize their retirement planning. First, automate contributions to your retirement accounts to ensure consistency. Many plans offer automatic escalation features, gradually increasing your contribution percentage over time.

Diversification is another essential principle. Investing across various asset classes reduces risk and enhances long-term returns. Young investors with a longer time horizon can afford to take on more risk through a higher allocation to equities, which historically offer higher returns than bonds or cash.

Revisiting and adjusting your retirement plan regularly is also important. Life circumstances, income levels, and financial goals change over time, making periodic reviews essential to stay on track.

Finally, prioritize financial literacy. Understanding the nuances of different retirement accounts and investment options empowers young professionals to make informed decisions that will shape their financial future. By starting early and leveraging the right retirement plans, young professionals can lay the foundation for a secure and comfortable retirement.