Managing personal finances can feel overwhelming, especially when expenses seem to pile up faster than income arrives. The 50/30/20 budgeting rule offers a straightforward, flexible framework to organize your money, prioritize spending, and work toward financial stability. Popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan, this rule divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. Its simplicity makes it accessible for beginners, while its structure provides enough guidance to keep even seasoned budgeters on track. Below, we’ll explore how to implement this rule effectively, from understanding its components to tailoring it to your unique financial situation.

The first step in using the 50/30/20 rule is to determine your after-tax income, as this forms the foundation of your budget. If you’re employed, your after-tax income is the amount you take home after federal, state, and local taxes, as well as deductions like Social Security, Medicare, and any employer-sponsored retirement contributions. For those with irregular incomes, such as freelancers or gig workers, calculating a reliable monthly average is key. To do this, review your income over the past six to twelve months, identify patterns, and use a conservative estimate to avoid overestimating. Knowing your after-tax income gives you a clear starting point to allocate funds across the three categories.

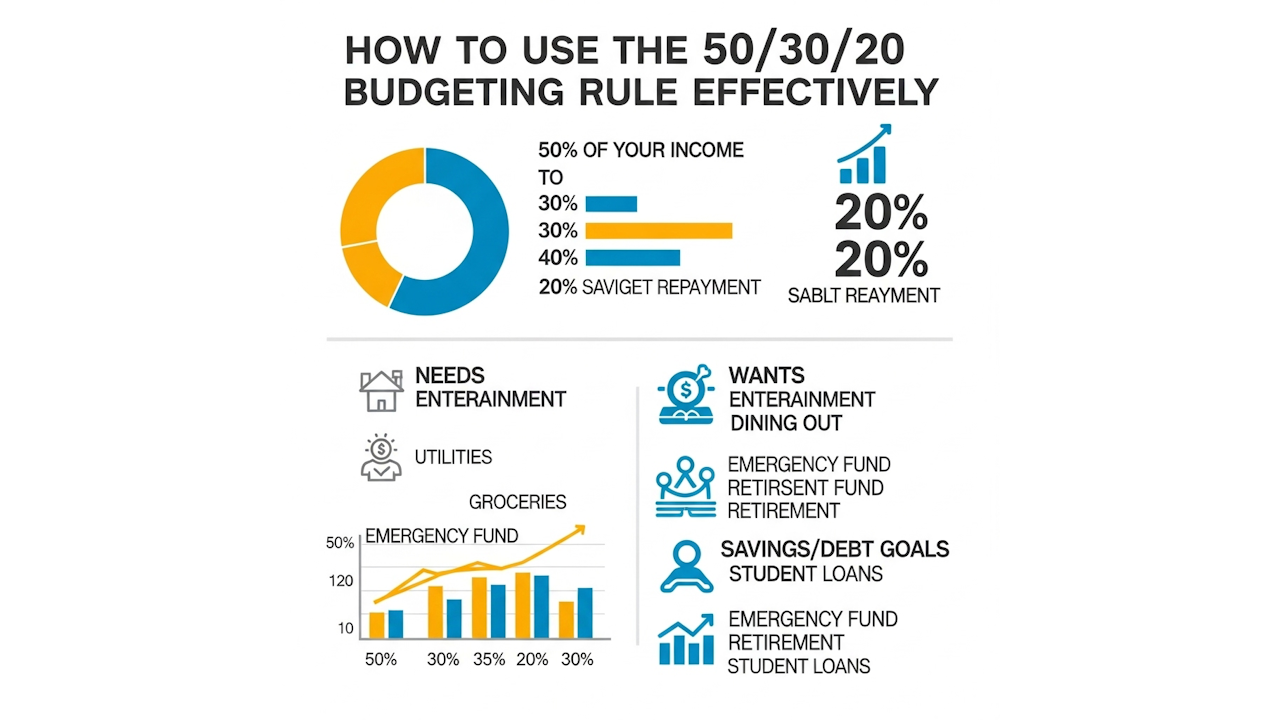

The “needs” category, which consumes 50% of your after-tax income, covers essential expenses required to maintain your basic standard of living. These include housing costs like rent or mortgage payments, utilities such as electricity, water, and internet, and groceries for everyday meals. Transportation expenses, whether car payments, gas, or public transit fares, also fall here, as do minimum debt payments and insurance premiums for health, auto, or renters’ coverage. The goal is to keep these expenses within half of your income. If your needs exceed this threshold, it may signal a need to reassess major costs, such as downsizing your home or finding more affordable transportation options. Tracking your spending for a month or two can help you identify which expenses truly qualify as needs and whether any can be trimmed.

The “wants” category, allocated 30% of your income, is where you have room to enjoy life’s non-essentials. This includes dining out, entertainment like streaming subscriptions or concert tickets, hobbies, travel, and discretionary purchases such as new clothes or gadgets. The distinction between needs and wants can sometimes blur, so it’s helpful to ask whether an expense is necessary for survival or simply enhances your lifestyle. For example, basic groceries are a need, but a meal delivery service or frequent restaurant visits are wants. By capping wants at 30%, the rule encourages mindful spending without eliminating the things that bring joy. If you find this category overflowing, consider small adjustments, like hosting a movie night at home instead of going to the theater or brewing coffee rather than buying it daily.

The final 20% of your income goes toward savings and debt repayment, a category that builds your financial future. Savings can include contributions to an emergency fund, retirement accounts like a 401(k) or IRA, or investments for long-term goals such as buying a home. An emergency fund, ideally covering three to six months of expenses, is a critical first step to protect against unexpected setbacks like job loss or medical bills. For debt repayment, this portion covers any payments above the minimums already accounted for in the needs category. Prioritizing high-interest debt, such as credit card balances, can save you money over time, as these often carry rates far exceeding potential investment returns. If you’re debt-free, this entire 20% can bolster your savings, accelerating your progress toward financial independence.

To put the 50/30/20 rule into practice, start by tracking your current spending to see how it aligns with the recommended percentages. Use bank statements, credit card records, or budgeting apps to categorize expenses over the past few months. This exercise reveals whether your needs, wants, or savings are out of balance. For instance, if your needs consume 60% of your income, you might need to negotiate lower rent, refinance a loan, or cut utility costs by conserving energy. If wants are taking up 40%, look for subscriptions or habits you can scale back. The goal isn’t perfection but progress toward the 50/30/20 split, even if it takes time to adjust.

Once you’ve assessed your spending, create a monthly budget that reflects the rule’s proportions. Divide your after-tax income into the three categories and assign specific expenses to each. For example, if your monthly take-home pay is $4,000, allocate $2,000 to needs, $1,200 to wants, and $800 to savings or debt repayment. Break these amounts down further into specific line items, such as $1,000 for rent, $300 for groceries, and $200 for entertainment. Automating payments for bills, savings contributions, and debt repayments can simplify the process and reduce the temptation to overspend. Many banks allow you to set up automatic transfers to separate accounts for each category, making it easier to stick to your plan.

Adapting the 50/30/20 rule to your circumstances is essential for long-term success. If you live in a high-cost city where housing alone eats up 40% of your income, fitting needs into 50% may feel impossible. In this case, you might temporarily adjust the ratios, such as 60/25/15, while working toward reducing major expenses or increasing your income. Similarly, if you’re tackling significant debt, you might allocate more than 20% to repayments, cutting back on wants until the balance is manageable. The rule is a guideline, not a mandate, so tweak it to fit your reality while maintaining its core principle of balancing essentials, enjoyment, and financial progress.

Staying disciplined with the 50/30/20 rule requires regular check-ins to ensure you’re on track. Set aside time each month to review your spending and adjust for any changes, such as a raise, new expenses, or unexpected costs. Life events like starting a family, changing jobs, or moving can shift your financial priorities, so be prepared to recalibrate. Budgeting tools or spreadsheets can help visualize your progress and highlight areas for improvement. Over time, these reviews build financial awareness, making it easier to spot patterns and make informed decisions.

One of the rule’s greatest strengths is its ability to evolve with your goals. As your income grows or debts shrink, you can redirect funds to accelerate savings or indulge in wants without derailing your budget. For example, paying off a car loan frees up money from the needs category, which you might split between savings and wants to maintain the 50/30/20 balance. Conversely, if you face a financial setback, the rule’s structure helps you prioritize essentials and savings while scaling back on wants. This adaptability makes it a sustainable approach for managing money through different life stages.

Common pitfalls can undermine the 50/30/20 rule if you’re not careful. Misclassifying expenses is a frequent mistake—treating a gym membership as a need rather than a want, for instance, can inflate your needs category and squeeze savings. Another challenge is lifestyle creep, where rising income leads to proportional increases in spending on wants. To avoid this, commit to maintaining the 30% cap on wants even as your paycheck grows, funneling extra income toward savings or debt repayment. Finally, neglecting to adjust the budget for irregular expenses, like annual insurance premiums or holiday gifts, can throw off your monthly allocations. Setting aside a small portion of each category for these costs can prevent surprises.

For those new to budgeting, the 50/30/20 rule offers a gentle entry point that doesn’t require meticulous tracking of every penny. Its broad categories reduce the complexity of managing dozens of expense types, allowing you to focus on big-picture goals. For experienced budgeters, it provides a framework to refine existing habits and ensure savings and debt repayment remain priorities. Regardless of your financial expertise, the rule’s flexibility makes it a powerful tool for building wealth and achieving peace of mind.

Ultimately, the effectiveness of the 50/30/20 rule lies in its balance of structure and freedom. It ensures your essential needs are met, allows room for enjoyment, and keeps your financial future in sight. By starting with a clear understanding of your income, categorizing expenses thoughtfully, and reviewing your progress regularly, you can harness this rule to take control of your finances. Whether you’re saving for a dream vacation, paying off student loans, or building a nest egg, the 50/30/20 rule provides a roadmap to get there without sacrificing the present for the future.