Retiring early is a dream for many, a vision of leaving the daily grind behind to pursue passions, travel, or simply enjoy life on one’s own terms. However, achieving this goal requires more than wishful thinking; it demands disciplined financial planning, strategic decision-making, and a commitment to long-term goals. Early retirement is not about luck or stumbling into wealth but about making intentional choices that prioritize financial independence. This article explores the principles and strategies for retiring early through smart financial planning, offering a comprehensive guide to building a future where work becomes optional.

The journey to early retirement begins with a clear understanding of what financial independence means. At its core, financial independence is the ability to cover living expenses without relying on a paycheck. For early retirees, this often translates to having enough savings or passive income to sustain their lifestyle for decades, potentially starting in their 40s or even 30s. The concept is rooted in the idea that time is more valuable than money, and with the right financial framework, one can trade years of labor for years of freedom. To achieve this, individuals must focus on three key pillars: maximizing income, minimizing expenses, and investing wisely.

One of the first steps in planning for early retirement is to assess current financial health. This involves taking a hard look at income, expenses, debts, and assets. Creating a detailed budget is essential, as it provides a snapshot of where money is going and highlights opportunities for optimization. Many aspiring early retirees find that their spending habits are misaligned with their long-term goals. For example, recurring small expenses, such as daily coffee runs or unused subscriptions, can add up to thousands of dollars over time. By tracking spending meticulously, individuals can identify areas to cut back without sacrificing quality of life. This process also helps in setting a realistic target for how much money will be needed to retire.

A critical component of early retirement planning is determining the “retirement number”—the amount of money required to sustain one’s lifestyle indefinitely. This figure depends on annual expenses, expected lifespan, and the rate of return on investments. A common rule of thumb is the 4% rule, which suggests that retirees can withdraw 4% of their portfolio annually without depleting it, assuming a diversified investment mix and a long time horizon. For instance, if someone expects to spend $40,000 per year in retirement, they would need a portfolio of $1 million. However, this rule is not universal, and factors like inflation, healthcare costs, and lifestyle preferences must be considered. To refine this estimate, individuals should project their expenses in retirement, accounting for changes such as lower commuting costs but potentially higher travel or hobby-related spending.

Maximizing income is another cornerstone of early retirement. While cutting expenses is important, there is a limit to how much one can reduce spending. Increasing income, on the other hand, has no ceiling and can significantly accelerate the path to financial independence. This might involve negotiating a higher salary, pursuing promotions, or transitioning to a higher-paying career. For those with entrepreneurial inclinations, starting a side business or freelancing can provide additional income streams. The key is to channel this extra income directly into savings or investments rather than letting lifestyle inflation erode the gains. Many successful early retirees adopt a mindset of living below their means, even as their income grows, ensuring that every additional dollar works toward their goal.

Debt management plays a pivotal role in early retirement planning. High-interest debt, such as credit card balances or personal loans, can derail even the most disciplined financial plan. The interest paid on these debts often outpaces the returns earned on investments, making debt repayment a priority. A strategic approach involves paying off high-interest debts first while maintaining minimum payments on lower-interest obligations, such as mortgages or student loans. For some, becoming completely debt-free before retirement is a psychological and financial milestone, as it reduces monthly expenses and increases flexibility. However, others may choose to carry low-interest debt, like a mortgage, if the payments are manageable and the funds can be better allocated to investments with higher returns.

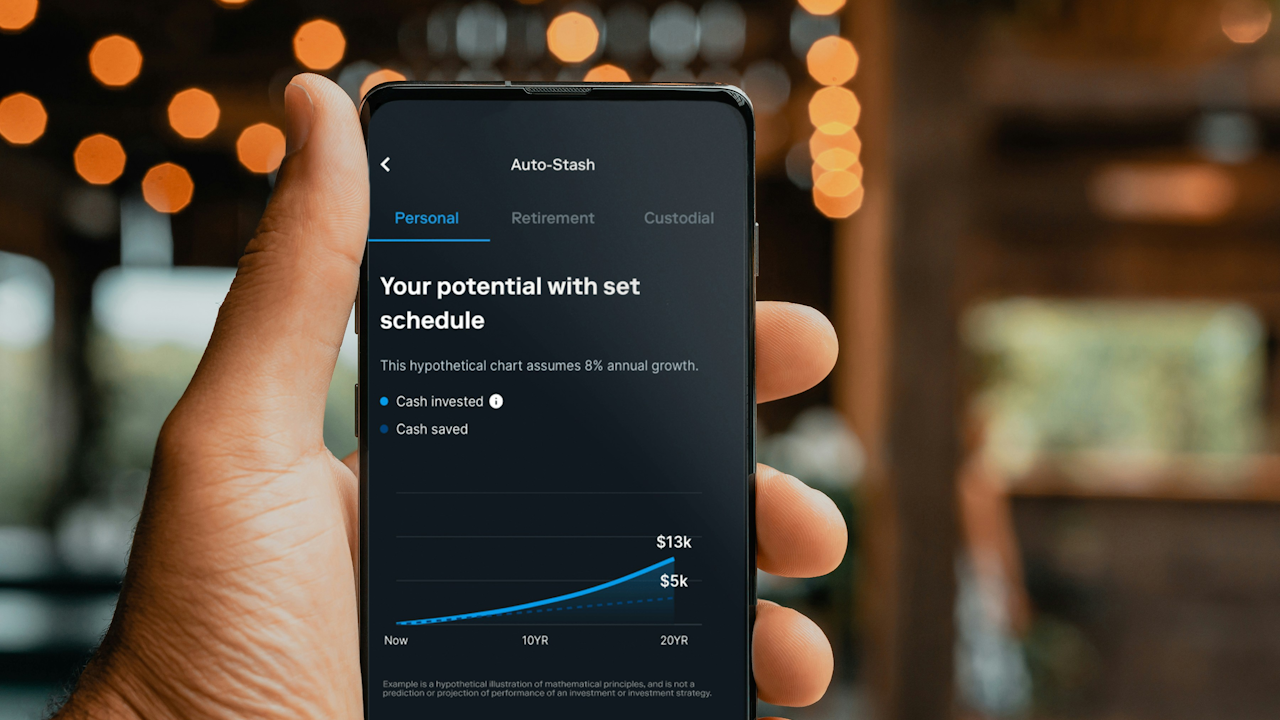

Investing is the engine that drives early retirement. The earlier one starts investing, the more time their money has to grow through the power of compounding. A diversified portfolio, typically consisting of stocks, bonds, and real estate, is essential for balancing risk and reward. Stocks, while volatile in the short term, historically offer higher returns over long periods, making them a cornerstone of most early retirement portfolios. Index funds and exchange-traded funds (ETFs) are popular choices due to their low fees and broad market exposure. Real estate can also be a valuable component, whether through rental properties or real estate investment trusts (REITs), providing both income and appreciation. The key is to align investments with one’s risk tolerance and time horizon, regularly rebalancing the portfolio to maintain the desired asset allocation.

Tax-advantaged accounts are a powerful tool for early retirees. In the United States, accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs) offer significant tax benefits, allowing money to grow tax-free or tax-deferred. Maxing out contributions to these accounts not only reduces taxable income but also accelerates savings growth. For those planning to retire before age 59½, when traditional retirement accounts typically allow penalty-free withdrawals, strategies like the Roth IRA conversion ladder or Rule 72t can provide access to funds without incurring penalties. Understanding the rules and limitations of these accounts is crucial, as tax efficiency can save tens of thousands of dollars over a lifetime.

Beyond traditional investments, creating passive income streams can enhance financial security in early retirement. Passive income sources, such as dividends, rental income, or online businesses, provide cash flow without requiring active work. Building these streams often requires upfront effort or capital but can pay off handsomely in the long run. For example, investing in dividend-paying stocks or creating a digital product, like an e-book or online course, can generate steady income. The goal is to diversify income sources to reduce reliance on any single stream, ensuring stability even if one source underperforms.

Healthcare is a significant consideration for early retirees, particularly in countries without universal healthcare systems. In the United States, retiring before age 65, when Medicare eligibility begins, requires careful planning. Private health insurance can be expensive, and unexpected medical costs can quickly deplete savings. One strategy is to use an HSA, which allows tax-free contributions and withdrawals for qualified medical expenses. Another approach is to explore part-time work that offers health benefits, providing coverage without the demands of a full-time job. Early retirees should also prioritize health and wellness, as maintaining physical fitness can reduce long-term medical expenses.

Lifestyle choices play a subtle but profound role in early retirement planning. The concept of “lifestyle creep,” where spending increases in proportion to income, is a common pitfall. To counter this, many early retirees embrace minimalism or intentional living, focusing on experiences rather than material possessions. This mindset not only reduces expenses but also aligns with the values of freedom and flexibility that drive the desire to retire early. For some, geographic arbitrage—moving to a lower-cost city or country—can stretch retirement savings further, allowing for a higher quality of life on less money.

The psychological aspect of early retirement should not be overlooked. Leaving the workforce can bring a sense of liberation but also challenges, such as loss of identity or social connections tied to work. Planning for this transition involves cultivating hobbies, building a community, and defining a sense of purpose outside of a career. Financial independence provides the freedom to explore these pursuits, but it requires proactive effort to ensure a fulfilling retirement. Many early retirees find that volunteering, mentoring, or pursuing creative projects fills the void left by work, creating a balanced and meaningful life.

Finally, flexibility is essential in early retirement planning. Economic conditions, personal circumstances, and market performance are unpredictable, and even the best-laid plans may need adjustment. Building a buffer into financial projections, such as saving more than the target retirement number or maintaining a part-time income stream, can provide peace of mind. Regularly reviewing and updating the financial plan ensures it remains aligned with goals and realities. For example, if investment returns are lower than expected, one might delay retirement by a year or two, or if expenses are higher, cutting back on discretionary spending can bridge the gap.

Retiring early is an ambitious but achievable goal with smart financial planning. It requires a combination of discipline, foresight, and adaptability, grounded in a clear vision of what financial independence means. By maximizing income, minimizing expenses, investing strategically, and planning for contingencies, individuals can turn the dream of early retirement into reality. The process is not without challenges, but the reward—freedom to live life on one’s own terms—is worth the effort. With each intentional step, the path to early retirement becomes clearer, transforming a distant aspiration into a tangible future.