Cryptocurrency investing often gets framed as chaotic, risky, and emotionally exhausting. Headlines focus on dramatic price swings, overnight millionaires, and devastating losses. While volatility is real, stress is not inevitable. With the right mindset, tools, and strategy, crypto can be approached calmly and thoughtfully. This guide focuses on practical ways to invest in crypto without letting it dominate your emotions, time, or mental health.

First, it is important to understand what crypto actually is and what it is not. Cryptocurrencies are digital assets that run on blockchain technology, which is a decentralized ledger maintained by a network rather than a single authority. Bitcoin was created as an alternative monetary system, while Ethereum and others expanded into platforms for applications, finance, and digital ownership. Crypto is not a guaranteed path to wealth, and it is not a lottery ticket. Seeing it as a long term technological experiment rather than a get rich quick scheme immediately lowers stress.

One of the biggest sources of anxiety in crypto investing is unclear goals. Before investing a single dollar, define why you are investing. Are you aiming for long term growth, diversification, learning about new technology, or passive income through staking. Clear goals help guide decisions and reduce impulsive behavior. Someone investing for ten years will react very differently to short term price drops than someone trying to trade daily.

Next, only invest money you can afford to lose. This advice is repeated often because it works. Crypto markets can drop sharply and unpredictably. If your rent, savings, or emergency fund is tied up in crypto, every market movement becomes stressful. By investing discretionary funds only, you create emotional distance from price fluctuations. Losses become manageable, and gains feel like bonuses rather than necessities.

Education is another powerful stress reducer. Many investors panic simply because they do not understand what they own. Take time to learn the basics of blockchain, tokenomics, and the specific projects you invest in. Read whitepapers, follow reputable analysts, and understand how a project creates value. When prices fall, knowledge provides context. You are less likely to panic sell when you understand the fundamentals behind an asset.

A simple and disciplined strategy is also key. One popular approach is dollar cost averaging, where you invest a fixed amount at regular intervals regardless of price. This removes the pressure of timing the market, which even professionals struggle to do consistently. By spreading purchases over time, you reduce the emotional highs and lows associated with buying at peaks or fearing crashes.

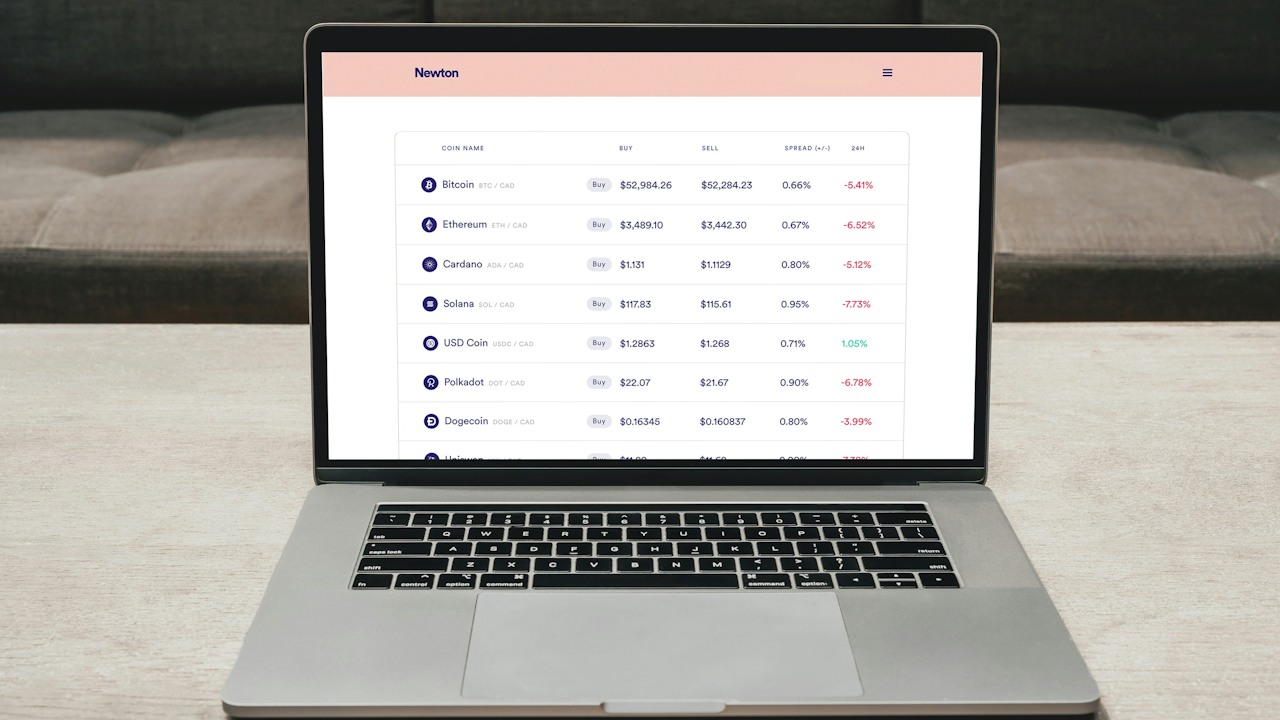

Diversification helps manage both financial and emotional risk. Holding a mix of assets, such as Bitcoin, Ethereum, and a small number of carefully researched alternatives, reduces dependence on any single project. Avoid overloading on obscure tokens just because they promise high returns. Complexity often increases stress. A focused, well balanced portfolio is easier to monitor and understand.

Security practices also play a major role in peace of mind. Use reputable exchanges, enable two factor authentication, and consider using a hardware wallet for long term holdings. Many crypto horror stories are not about market losses but about hacks, scams, and lost keys. Taking security seriously from the start prevents constant worry about losing assets through preventable mistakes.

Limiting exposure to constant market noise is another underrated strategy. Crypto markets operate twenty four hours a day, and endless price tracking can become addictive. Checking charts every few minutes amplifies anxiety and encourages emotional decisions. Set boundaries for how often you review your portfolio. For long term investors, once a week or even once a month is often enough.

It is also important to recognize emotional cycles in markets. Fear and greed drive extreme behavior. During bull markets, optimism can lead to overconfidence and reckless risk taking. During bear markets, fear can cause investors to sell at the worst possible time. Being aware of these patterns helps you step back and respond rationally instead of reacting emotionally.

Finally, accept uncertainty. Crypto is still a young and evolving space. Regulations change, technologies compete, and some projects will fail. Stress often comes from trying to control outcomes that cannot be controlled. Focus instead on what you can manage, such as your research, position size, time horizon, and emotional discipline. Acceptance creates resilience.

In conclusion, investing in crypto without stress is less about predicting prices and more about building healthy habits. Clear goals, limited risk, continuous learning, simple strategies, strong security, and emotional awareness all work together to create a calmer experience. Crypto does not have to be a roller coaster. With intention and discipline, it can be a manageable and even rewarding part of a balanced investment journey.